Jan 12, 2024

Goldman’s Key Man on Board to Step Down After BlackRock Deal

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc.’s lead independent director plans to step down from the board, a significant departure from a panel that stood by Chief Executive Officer David Solomon through a period of discontent within the firm.

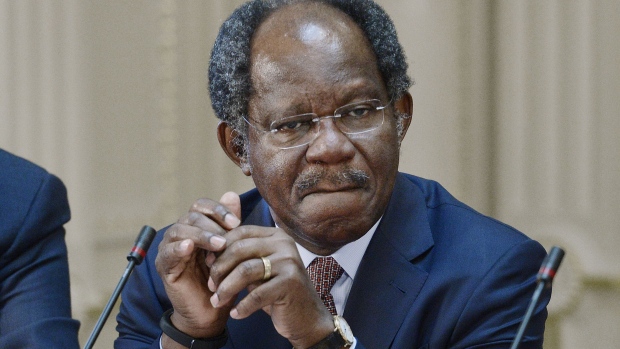

Bayo Ogunlesi, 70, will vacate the post after the sale of Global Infrastructure Partners, the investment firm he helped found in 2006, to money-management giant BlackRock Inc. The former investment banker has been a fixture for over a decade, bridging the tenures of CEOs Lloyd Blankfein and Solomon.

As part of the deal, which is expected to close later this year, Ogunlesi will join BlackRock’s board. Goldman wasn’t listed as an adviser on the transaction.

“He has been a deeply engaged director, who challenged all of us,” Solomon said. The firm will evaluate Ogunlesi’s remaining tenure on the board “given this change in circumstance” and pick a new lead director later, the Goldman CEO added.

As lead independent director, Ogunlesi is the most powerful member of the panel aside from Solomon, its chairman. Though Ogunlesi has rarely made public waves in that role, a conversation he had with banking analyst Mike Mayo in September, expressing support for Solomon, sent a message to disgruntled employees and was widely noticed across Wall Street.

The director acknowledged the board could have done better in its oversight of Goldman’s troubled foray into consumer lending its pace of divesting balance-sheet investments, and in encouraging a faster move on third-party fundraising. And while turnover is the norm, he noted that disagreements cost Goldman some partners it wanted to keep.

Since Solomon took the helm, Goldman has recruited several new board members from other parts of the corporate world. And in mid-2023, it notably enlisted another experienced banker, Tom Montag — a longtime Goldman alum who had left for Bank of America Corp., where he rose to second in command.

Ogunlesi’s election to Goldman’s board in 2012 was a surprise, considering the New York-based firm had previously balked at allowing one of its directors to work at a private equity company, perceiving such investment firms as both clients and competitors. He was named lead director in 2014.

Born in Nigeria, he has degrees from Oxford University, Harvard Law School and Harvard Business School. He was a clerk to late US Supreme Court Justice Thurgood Marshall and worked as an attorney at Cravath, Swaine & Moore before joining Credit Suisse in 1983, where he spent over two decades.

(Updates with Goldman CEO comment in fourth paragraph.)

©2024 Bloomberg L.P.