Apr 8, 2022

Goldman Sachs Traders Make $300 Million on Inflation in First Quarter

, Bloomberg News

(Bloomberg) -- Traders at Goldman Sachs Group Inc. have made hundreds of millions of dollars from inflation trading so far this year, as the Wall Street giant benefits from the war-fueled surge in European consumer prices.

The bank generated about $300 million in the first quarter from dealing in bonds and derivatives tied to inflation, about double the tally of the same period a year ago, according to a person familiar with the matter. The lender’s traders made much of their money from euro-based transactions, an already-surging market that has jumped to unprecedented levels since Russia’s invasion of Ukraine, the person said.

The post-lockdown surge in consumer prices since last year may have spawned a global cost-of-living crisis but it has turned into a goldmine for traders who focus on inflation. Goldman Sachs made about $450 million from the business for all of 2021, double what the firm made in previous years, Bloomberg reported in February.

Sebastian Howell, a spokesman for Goldman Sachs in London, declined to comment.

Euro-area inflation in March jumped past analysts’ forecasts to 7.5%, the highest year-on-year rate in the history of the single currency. Households and businesses across the European Union have been slammed with hikes in energy costs as the Russian invasion roils the continent’s access to oil and gas, worsening a crisis in the cost of commodities that set in last year.

The rise in prices has forced governments across the bloc to spend billions of dollars on aid programs. The European Central Bank may raise interest rates to deal with inflation that’s now more than three times its 2% target. In France, Marine Le Pen has targeted the issue in her campaign to oust President Emmanuel Macron in elections that begin this Sunday.

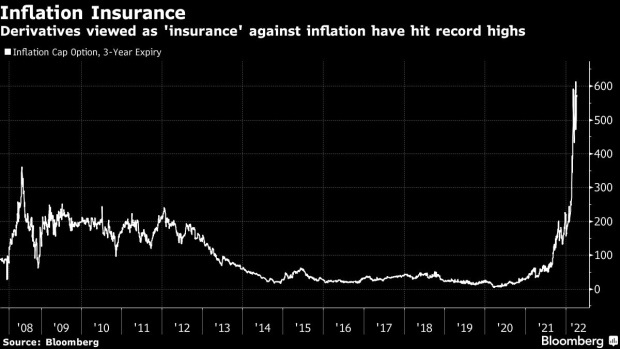

Investors have rushed to protect their holdings and speculate for short-term gains. The cost of options that pay out if inflation climbs above 2% -- viewed in the market as a form of insurance -- have climbed to previously-unseen levels.

For Goldman Sachs, the geopolitical volatility has meant more profit. Nikhil Choraria, who helps oversee the inflation-trading business in London, has thrived by predicting the surge in the continent’s prices.

a

Choraria has focused on derivatives tied to short-term or “front-end” inflation, the person said. This market became increasingly volatile during the first quarter as Russian tanks rolled into Ukraine, according to Michael Riddell, who manages about $8 billion at Allianz Global Investors. This kind of uncertainty can make traders a lot of money, he said.

“It’s not uncommon for bank trading desks to make money when you have big volatility events, although a few can also lose money too if they get caught on the wrong side,” Riddell said. “Front-end inflation markets were as volatile as it gets.”

©2022 Bloomberg L.P.