Mar 23, 2024

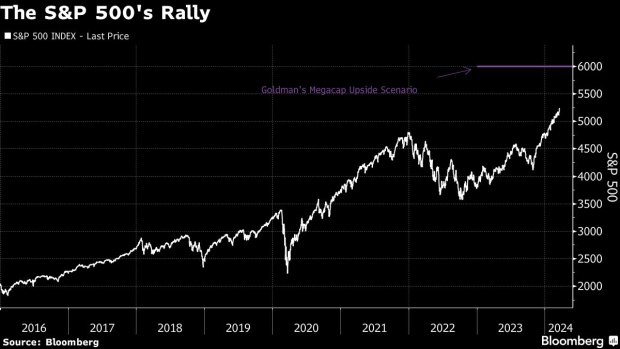

Goldman Says Megacap Bull Case Might Take S&P 500 to 6,000

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. strategists are sticking with their year-end S&P 500 forecast level of 5,200, but have a scenario in which tech megacaps lead the index up another 15%.

The firm is sticking with its current prediction because the federal funds rate path and economic-growth trajectory are fully priced by markets, strategists led by David Kostin wrote in a note. As the outlook for valuations was uncertain, the analysts explored potential scenarios outside of the base case.

One of those is the idea that valuations of megacap tech companies may continue to expand, sending the gauge to 6,000 by year-end and reaching a forward price-to-earnings ratio of 23, they said.

“Although AI optimism appears high, long-term growth expectations and valuations for the largest TMT stocks are still far from ‘bubble’ territory,” the strategists wrote.

The S&P 500 is up almost 10% this year and closed Friday at 5,234.18. That’s already left many strategists’ year-end forecasts in the dust. The combination of healthy US economic data, expectations the Federal Reserve will cut rates and optimism about artificial intelligence stocks are among the factors that have helped the gauge advance.

A large part of the market remains weighed down by concerns of “high-for-longer” rates and an elevated cost of capital as investors seek quality attributes, Goldman noted. That’s one area where a change might help stocks go higher.

“A shift in the interest rate outlook without a deterioration in the economy is necessary for the market rally to broaden,” the strategists said.

Goldman gave estimates of where the index may be headed in several other scenarios. In one, a “catch-up” to pre-pandemic 2018 valuations might see the gauge end the year at 5,800, they said.

The other two are much more bearish — a “catch-down” situation where sales-growth estimates prove too optimistic, or where investors start to price in the risk of a recession. Either of these might see the S&P 500 end the year at 4,500, the strategists said.

©2024 Bloomberg L.P.