Nov 17, 2022

Goldman Turns More Bullish on China Stocks, Upgrades South Korea

, Bloomberg News

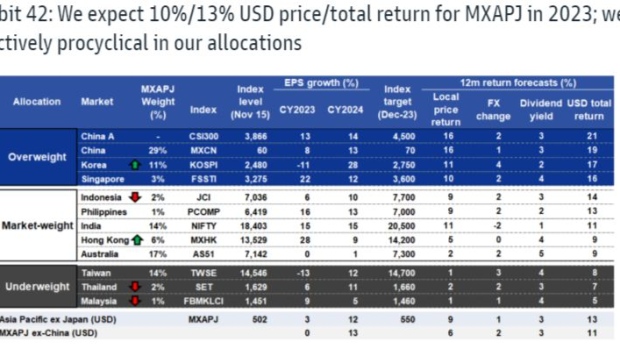

(Bloomberg) -- Goldman Sachs Group Inc.’s analysts turned bullish on the equity markets of China and South Korea, predicting they will outperform in 2023 as Beijing relaxes its Covid-Zero policy and the global backdrop improves.

Both the MSCI China benchmark and the country’s CSI 300 Index will rise by 16% in the next 12 months, the most in the region, strategists including Timothy Moe wrote in a note. They also raised South Korea to overweight from neutral, and Hong Kong to market weight.

“Regional equity leadership may shift north after Asean and India strength in 2022 as China markets rebound and Korea anticipates recovery,” the analysts said. The second quarter in 2023 is a potential inflection point for Asian equity markets as the dollar peaks with the Federal Reserve pivoting, they wrote.

An increasing number of Wall Street banks and investors are calling for a rebound in emerging markets and China, as policy makers in the world’s second-largest economy pivot toward supporting growth. Benchmark indexes in Hong Kong have surged into bull markets in recent weeks, after being the world’s worst performers for much of this year.

A relaxation of Covid restrictions and support for developers have led some money managers to say the worst is over for Chinese equities. Others like JPMorgan Asset Management though see US investors continuing to reallocate funds from China to other emerging markets due to uncertainties surrounding its domestic politics and US tensions.

Read: Fund Titans Are Buying China Stocks on Bets Worst Is Now Over

“We estimate China offshore equities can rally 20% on reopening and favor our reopening beneficiaries stock list,” Goldman analysts wrote. They expect the nation to gradually relax Covid restrictions in the second quarter of 2023.

The analysts expect South Korea’s Kospi Index to rally 11% in the next 12 months, while the benchmark in Singapore could gain 10%. Foreign buying and a rally in chip stocks have turned the Kospi into the best-performing benchmark in the region this quarter.

The analysts downgraded Indonesia to neutral, and Thailand and Malaysia to underweight. Goldman had slashed its 12-month target for the MSCI Asia Pacific Excluding Japan Index to 515 from 585 on Sept. 30. The gauge has since risen by about 10%, taking it to 3.7% short of the expected level as of yesterday’s close.

That global macro backdrop means taking “a measured approach to start the year and then taking more risk as the macro-outlook improves,” the Goldman analysts wrote.

(Updates to add more context on China rebound and more comments from Goldman Sachs.)

©2022 Bloomberg L.P.