Mar 1, 2024

GQG’s $19 Billion Fund Says Chinese Stock Rally Is ‘Confusing’

, Bloomberg News

(Bloomberg) -- The rebound in Chinese stocks is puzzling given the lack of support from earnings growth, according to an emerging markets fund manager at GQG Partners LLC.

It’s difficult to ascertain the state of the market recovery as measures taken by the Chinese authorities have led to a “confusing” environment impacting price discovery, particularly when earnings growth remains weak, Sudarshan Murthy, co-manager of the $18.8 billion GQG Partners Emerging Markets Equity Fund, said in an interview by phone last week.

Benchmark Chinese stock gauges soared more than 9% in February, snapping months of losses, after the authorities clamped down on quants and high-speed trading, with analysts also pointing to purchases made by state-backed funds. Murthy’s questions underscore how global investors are unconvinced by the gains, given an economy struggling with deflation and a property crisis.

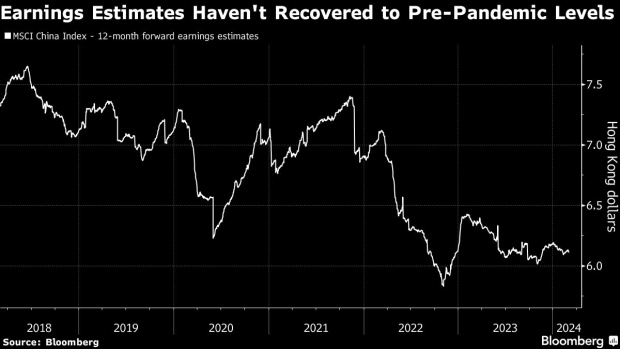

“It’s symptomatic of a broader problem,” Murthy said, referring to the recent policy measures. “We’re still waiting and evaluating the data. Maybe it’s confusing for all of us. I think the key is to get some comfort on the sustainability of earnings growth because the last five years haven’t been good.”

On Friday, the Nasdaq Golden Dragon China Index, a gauge of US-listed Chinese stocks, gained 1.1% in early US trading.

GQG’s emerging markets fund beat 99% of peers with a 38% return in the past year, data compiled by Bloomberg shows. It had only 5.7% of its portfolio in China equities as of end-January.

Earnings for the MSCI China Index are estimated to have grown a mere 1.6% in 2023, with the five-year average showing a 3.3% decline. In the previous decade, the average annual gain was 6%.

“For a variety of reasons, the larger companies in China were not delivering on earnings growth,” said Murthy. While there are reasons for regulators to crack down on quant funds, it may lead to “unintended consequences” as “investors like a stable regulatory environment,” he said.

Others have questioned the sustainability of the rally. UBS Global Wealth Management is “staying defensive”, citing multiple false dawns. Hedge funds have added short positions amid the rebound, Morgan Stanley said last month.

--With assistance from Kit Rees.

(Updates to add detail on Nasdaq Golden Dragon China Index in fifth paragraph.)

©2024 Bloomberg L.P.