Nov 10, 2022

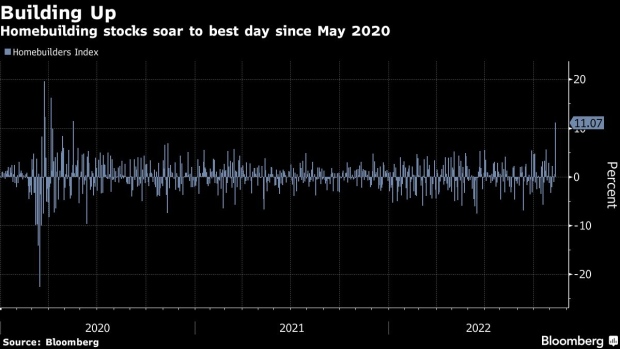

Hard-Hit Homebuilders Soar Most Since May 2020 on Inflation Data

, Bloomberg News

(Bloomberg) -- D.R. Horton Inc., Lennar Corp. and other homebuilder companies’ shares staged the biggest rally in more than two years as a slowdown in the pace of inflation fueled bets that the Federal Reserve will start dialing back the pace of its interest-rate hikes.

The S&P Supercomposite Homebuilding Index surged 12%, the most since April 2020, after a smaller-than-expected rise in consumer prices last month ramped up hopes that the central bank’s aggressive monetary policy tightening is reining in inflation. That sent Treasury yields tumbling, promising to pull mortgage rates back from the steep jump that’s weighed on the real estate industry.

Two of the largest builders in the US, Lennar and D.R. Horton rose 13% and 11%, respectively. Other gainers include Century Communities Inc., which rose 14%, and KB Home, which climbed 11%.

Homebuilders’ stocks have been slammed this year by a surge in mortgage rates, as the increased borrowing costs have eroded the affordability of their products and consumers’ demand. Mortgage rates data from Freddie Mac on Thursday morning showed the 30-year rate above 7%.

Even after the gains, the S&P homebuilder index is still down about 27% this year.

(Updates to market close throughout.)

©2022 Bloomberg L.P.