Mar 22, 2024

Hedge Funds Boost Bearish Yen Bets After BOJ’s Dovish Hike

, Bloomberg News

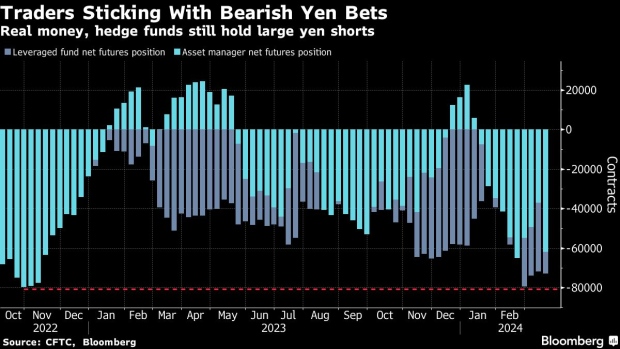

(Bloomberg) -- Hedge funds ramped up bearish yen wagers in the week stretching through the Bank of Japan’s March meeting, when officials ended the world’s last negative rate-regime but pledged an accommodative stance that dragged the Japanese currency to 2024 lows.

Leveraged speculators in the currency market increased their holdings of contracts tied to bets that the Japanese currency will fall to 80,805, approaching the six-year high of 83,562 reached last month, according to data through March 19 from the Commodity Futures Trading Commission — the week culminating in the day when BOJ ended its negative rates policy in Japan.

The yen fell more than 1% against the dollar following the conclusion of the central bank’s meeting Tuesday, and is now set for a second weekly drop.

Hedge funds have been consistently short the yen since 2021, according to CFTC, with the trade remaining popular in recent months on expectations that the BOJ’s pursuit of policy normalization will nonetheless remain accommodative.

Read more: Why the Yen Is So Weak and What That Means for Japan: QuickTake

The anticipated rate hike by the BOJ ultimately did little to narrow the gap between yields in the US and Japan, where the yen remains a common funder of carry trades — in which macro traders sell low-yielding currencies in order to buy higher-yielding investments abroad.

“The BOJ’s shift is colored by dovish language - which makes it unlikely that we’ll see capital repatriated en masse,” CIBC’s global head of foreign-exchange strategy in Toronto, Bipan Rai, wrote in a note after the central bank’s announcement. “Over the medium-to-long term, the JPY will still remain an important funder for carry trades.”

Without clear guidance, traders are now guessing when the next rate hike may come. The yen has been the worst performer against the dollar in the Group-of-10 currencies so far this year, losing nearly 7% versus the greenback. It also led losses among the group in 2023.

Read More: BOJ Watchers See Next Rate Hike by October, Risk of Faster Moves

Asset managers also increased bets against the yen, while leveraged funds turned more bearish on the euro, Australian dollar and Canadian dollar.

- Leveraged funds adjusted net positions as follows:

- Increased net JPY short by 5,951 contracts to 80,805

- Increased net EUR short by 11,627 contracts to 32,921

- Raised net GBP long by 8,424 contracts to 31,078

- Increased net AUD short by 22,067 contracts to 31,791

- Trimmed net NZD long by 1,890 contracts to 1,383

- Raised net CAD short by 2,142 contracts to 23,400

- Reduced net CHF short by 4,396 contracts to 2,798

- Raised net MXN long by 15,849 contracts to 45,186

- Asset managers changed net positions as follows:

- Raised net JPY short by 25,624 contracts to 59,529

- Decreased net EUR long by 21,923 contracts to 307,858

- Raised net GBP short by 17,341 contracts to 36,709

- Cut net AUD short by 853 contracts to 100,425

- Added net NZD short by 7,303 contracts to 11,928

- Raised net CAD short by 5,807 contracts to 45,891

- Added net CHF short by 5,866 contracts to 13,297

- Increased net MXN long by 9,780 contracts to 173,897

©2024 Bloomberg L.P.