Jun 16, 2021

Hedge Funds Push Deeper Into Private Equity’s Turf in Asia

, Bloomberg News

(Bloomberg) -- Asian hedge fund firms are pouring hundreds of millions of dollars into private investments as they seek higher returns, muscling into an area that has long been the preserve of private equity and venture capital.

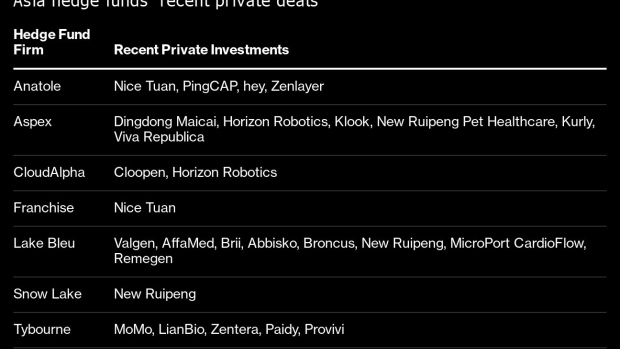

Aspex Management, Tybourne Capital Management, Anatole Investment Management and Lake Bleu Capital, which are based in Hong Kong and between them manage more than $20 billion, have made dozens of investments in private companies since the beginning of last year, according to public filings and people familiar with the matter, who asked not to be identified discussing private information.

The influx of hedge fund money is increasing competition for stakes in the most promising companies before they go public, a space where global firms like Tiger Global Management and Japan’s SoftBank Group Corp. are prolific investors. The region’s hedge funds are looking beyond listed companies as it becomes harder to generate the returns that investors are seeing in private markets.

“We are seeing a proliferation of hedge funds,” said Eric Woo, co-founder of Revere, a San Francisco-based asset manager focused on venture capital. “They can be quite disruptive, because they can be a lot more fast-paced and bring competition to traditional venture funds.”

Asia has more than a quarter of the world’s 700 or so private companies valued at more than $1 billion known as unicorns, according to CB Insights. In addition to venture firms, private equity are also investors in such companies.

Read More: Asia Hedge Funds Join SPAC Craze in Race to Back Next Grab

Aspex Management, which managed $5 billion at the end of March, has participated in private financing rounds of at least five companies. Tybourne, with $8.6 billion under management, made investments in a Vietnamese e-wallet company and pharmaceuticals. Healthcare specialist Lake Bleu manages almost $3 billion and has made more than 40 private investments since 2018, a person with knowledge of the matter said.

Some managers which did not previously have mandates to invest in unlisted companies are now seeking investor permission to do so, said Liyen Chow, Asia head of capital introduction at Goldman Sachs Group Inc. Newer funds have begun trading with greater flexibility to make bets on private companies, such as Hermes Li’s two-year-old Aspex, and Apah Capital Management Ltd., started by Li’s former Och-Ziff Capital Management colleague Anand Madduri this year.

In private deals, Asia hedge fund firms tend to zero in on late-stage growth companies within three years of going public. That strategy helps form closer ties with management and hopefully secure bigger allocations of IPO shares for the next Alibaba Group Holding Ltd. or ByteDance Ltd. Myriad Asset Management and Janchor Partners made huge gains on their 2012 investments after Alibaba, then a private company, launched the world’s biggest-ever initial public offering at the time.

Such bets can also easily sour. Earlier this year, Fidelity Investments halved the valuation estimate for its shares in Ant Group Co. after the fintech giant’s $35 billion IPO was halted abruptly as Chinese regulators began an overhaul of the fintech industry.

What’s more, funds can risk a conflict of interest if they share information gathered from private markets and use it for public market trading, said Liao Ming, founding partner of Prospect Avenue Capital, a venture capital firm which manages $500 million in assets.

Some firms ringfence their private investments in so-called side pockets to separate them from more liquid holdings. Other hedge funds have launched private equity-like funds dedicated to such investments.

One such vehicle raised by Tybourne disclosed $325 million of assets, which includes gains from exiting some of the investments and stock moves, in March. The Hong Kong-based manager is approaching investors for a second such fund, according to regulatory filings. Pleiad Investment Advisors raised nearly $150 million for a fund that will specialize in private investments in Japan. Investors committed $560 million to the second private equity-type fund started by Lake Bleu by November, the person familiar with the matter said. That is four times the amount fetched by a fund a year earlier.

“Late stage is going to be the playground of hedge funds going forward,” said George Yang, chief investment officer at Anatole. “They will gradually replace private equity funds focused on late-stage growth companies.”

©2021 Bloomberg L.P.