Oct 31, 2022

Hong Kong Growth Forecasts Slashed as Global Risks Intensify

, Bloomberg News

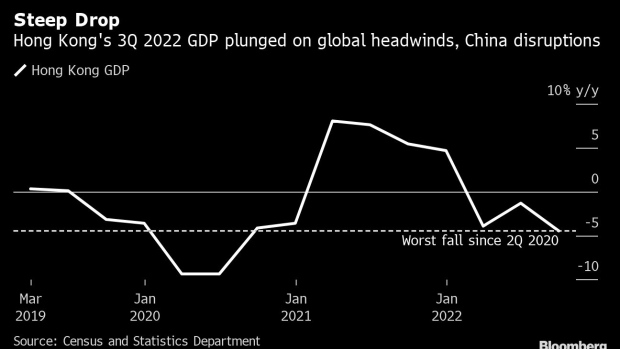

(Bloomberg) -- Economists slashed their forecasts for Hong Kong’s full-year growth this year after the financial hub recorded its worst quarter since 2020, with surging global interest rates and the slump in trade leaving little hope it can avoid contraction in 2022.

Goldman Sachs Group Inc. late Monday said it expects Hong Kong’s 2022 gross domestic product to shrink 3.2% from an expected 1.4% decline previously, citing the weaker-than-expected slowdown in the third quarter.

Citigroup Inc. economists on Tuesday cut their full-year growth forecast to a 2.6% fall from a 0.3% expansion previously, also citing the deteriorating economic picture. United Overseas Bank Ltd. downgraded its forecast for 2022 to a 3% contraction from a 0.7% decline, adding that there is “a lack of catalysts for stronger recovery.”

Goldman and Citi also trimmed their forecasts for 2023, projecting a smaller rebound than previously expected.

The city on Monday recorded a 4.5% plunge in GDP for the July-to-September period from a year earlier, far below the median estimate of a 0.8% slump in a Bloomberg survey. Government officials blamed the fall on cargo disruptions along the border with China, which is tightening Covid restrictions to combat outbreaks there.

“We don’t see a lot of improvement in the Hong Kong economy if the mainland border is still closed and if the external market is going to be worse than the current situation,” said Iris Pang, chief economist for Greater China at ING Groep NV. She has revised her full-year GDP forecast to zero growth from a 2.4% expansion previously.

The data also showed a sharp contraction in investment, largely due to rising interest rates as Hong Kong follows the US Federal Reserve in its aggressive policy tightening. Economists cited property sector turmoil, flat consumption and a collapse in trade as additional factors.

Hong Kong’s consumption recovery, meanwhile, has remained slow despite support from consumption vouchers. Retail sales value in September rose just 0.2% from a year ago, the Census and Statistics Department said Tuesday, missing economists’ estimates of a 1.7% increase. Sales volume dropped 1.5% from a year ago, worse than economists’ expectations of a 0.3% fall.

The spending vouchers will support demand, though “tightened financial conditions will increasingly offset the positive effects,” a government spokesman said in a statement accompanying the data.

The economist downgrades are much worse than the government’s own forecast of a contraction or an expansion in the range of -0.5% to 0.5% in 2022, though that projection is from August.

Should the economy contract, it would be the third time since 2019.

The combination of headwinds creates a tough road ahead for Hong Kong, which had earlier this year been stymied by some of the world’s harshest pandemic control measures that effectively kept tourists out, dampened spending and led to a brain drain.

While most of the measures have been rolled back, economists say it will be difficult to recover even if the government retires remaining restrictions, such as movement curbs on arrivals.

The global trade outlook is worsening, with South Korea recording its first decline in exports in two years. Hong Kong’s exports declined for five straight months through September, as its own struggles were exacerbated by China’s pandemic problems.

The Citi economists cited pessimism over China’s growth and border reopening prospects -- along with capital outflows and a quickening drop in property prices -- as likely to make the next couple of quarters “even as local Covid restrictions ease further.”

Rate increases, meanwhile, are likely to keep weighing on the economy, with the Fed expected to hike rates by another 75 basis points this week. The Hong Kong Monetary Authority will announce its decision Thursday, though it moves in lockstep with the US central bank. That might pressure the biggest banks to raise their main lending rates again after doing so in September for the first time in four years.

Bloomberg Economics said Monday it sees GDP shrinking 3.4% in 2022, a deeper drop than earlier anticipated as slowing global demand, rising interest rates and China’s Covid Zero restrictions outweigh any efforts locally to lift the city’s remaining Covid curbs.

Chief Executive John Lee, meanwhile, has given no indication of when remaining rules, including testing restrictions for arrivals, will be lifted, saying at a press briefing Tuesday that the city’s “road map remains the same, which is moving steadily forward.”

He pointed to major international events as having a “positive effect on reviving Hong Kong’s economy.” The city this week is hosting conferences including a global finance summit intended to signal its return to the global stage -- though the much-touted event has been marred by a couple of high-profile executive dropouts and an approaching tropical cyclone.

Lee has taken other steps to help the economy, announcing last month a raft of measures aimed at wooing back foreign talent and easing property pressures. But economists and investors have said the proposals fell short of major policy reform, and the city faces another pressure point in its budget shortfall, which may triple this year from earlier estimates.

--With assistance from Kari Lindberg and Shirley Zhao.

(Updates with retail sales numbers for September.)

©2022 Bloomberg L.P.