Jan 19, 2022

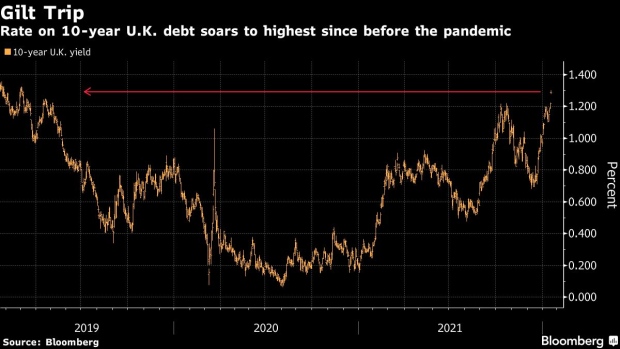

Hot Inflation Fuels U.K. Rate Hike Bets With Yields at 2019 High

, Bloomberg News

(Bloomberg) --

Hot U.K. inflation data is prompting traders to double-down on rate-hike bets, sending benchmark gilt yields to the highest since 2019.

The yield on 10-year U.K. government bonds soared through 1.30% on Wednesday following a report showing that Britain’s inflation rate surged unexpectedly to the highest since 1992.

The U.K. has been at the forefront of a global bond selloff since mid-December, with yields rising around half a percentage point. Debt markets extended losses on Wednesday, with benchmark German yields turning positive for the first time since 2019 and equivalent rates in Treasuries closing in on 2%.

“Inflation surging to its highest rate in 30 years further bolsters the case for additional interest rate hikes from the BOE as the central bank remains under pressure,” said Sam Cooper, vice president of Market Risk Solutions at Silicon Valley Bank. It confirms “market expectations that inflation needs to be addressed in the coming months.”

Money markets have almost fully priced a hike in February to 0.5%, a level that could pave the way for the Bank of England to start reducing its balance sheet by stopping the reinvestment of expired bonds. Further out, they see the key rate rising as high as 1.5% in around 18 months, according to SONIA forwards.

The yield on 10-year U.K. bonds was up six basis points at 1.28% as of 8:25 a.m. in London.

The BOE’s Next Move Is About More Than an Interest-Rate Hike

“Price gains are fairly broad-based, which means that it is less likely that inflationary pressures will clear out once energy costs start to moderate -- placing increased pressure on the BOE’s hiking cycle,” said Ima Sammani, an analyst at Monex Europe.

©2022 Bloomberg L.P.