Apr 8, 2022

How Kenya’s Debt Service Obligations Climbed to $12 Billion

, Bloomberg News

(Bloomberg) -- Kenya is poised to spend a record amount of money on servicing its liabilities, hampering the government’s efforts to ease the debt burden while still sustaining economic growth.

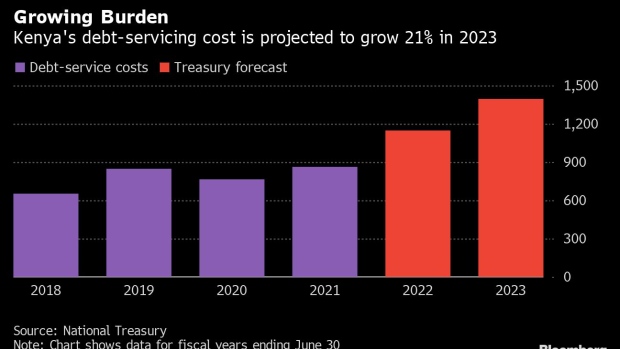

The East African nation’s debt-servicing costs will climb to 1.39 trillion shillings ($12.1 billion) in the year starting July 1, according to budget documents presented to lawmakers on Thursday. That’s 21% more than the estimated cost in the current fiscal year.

The costs more than doubled from five years ago as President Uhuru Kenyatta’s administration ramped up borrowing, partly to fund an ambitious infrastructure program of roads, railways and ports. Kenya’s debt topped 8 trillion shillings at the end of last year, compared with 1.8 trillion shillings in 2012-13.

Kenya’s fiscal position came under more pressure from the coronavirus pandemic. The economic fallout hit revenues and forced the National Treasury to seek loans, including $739 million from the International Monetary Fund in May 2020, to boost its response.

The obligations have grown along with the economy, whose size the government expects to be almost 13 trillion shillings by the end of June. Still, debt-servicing costs represent almost 60% of the projected state revenue in the next fiscal year.

The Treasury proposed expenditure of 3.34 trillion shillings for 2022-23, most of which will go to recurrent spending such as paying salaries.

“The government might have to borrow to fund recurrent expenditure” given the deficit and development spending of at least 715 billion shillings, according to a PwC note.

©2022 Bloomberg L.P.