Nov 29, 2022

How Serious Is Poland About Building a Nuclear Future?

, Bloomberg News

(Bloomberg) -- Nearly two decades after Poland set its sight on obtaining atomic energy, the government in Warsaw picked two separate foreign partners within three days to build its first nuclear power plants. The sudden rush in deal-making and unexpected changes of plans are prompting questions about how serious the government is about the endeavor that was meant to reduce the economy’s reliance on coal. The prospect of general elections late next year is further complicating the picture.

Why does Poland want nuclear power?

The European Union’s largest eastern economy relies on coal for more than 70% of its electricity generation and needs to exit the dirty fuel by 2050 to meet the bloc’s climate goals. Nuclear power is seen as Warsaw’s best bet for clean and stable energy that would replace aging coal plants without relying on weather-dependent wind and solar.

Russia’s invasion of Ukraine has also made imports of gas prohibitively expensive, casting doubt over plans to replace coal plants with gas-fired ones. Poland’s only attempt to build an atomic reactor, based on Soviet technology, was halted after the Chernobyl disaster in 1986. Government plans envisage 6-9 gigawatt of nuclear energy by the mid-2040s.

Will there be two different nuclear projects?

It appears so, although some hurdles remain. Prime Minister Mateusz Morawiecki picked US-based Westinghouse Electric Co. as its partner for a government program aimed at building six reactors. However, Poland committed only to three units thus far for about $20 billion, leaving the decision on the remainder for later -- with Korea Hydro & Nuclear Power Co. and Electricite de France SA in the running for the contract.

Meanwhile, Deputy Premier Jacek Sasin signed a preliminary agreement with the Korea Hydro utility for a separate plant, to be built outside the government’s nuclear program, by the biggest state-run power producer PGE SA and billionaire Zygmunt Solorz Zak’s utility ZE PAK SA.

What obstacles hinder this strategy?

Firstly, it will be more costly to develop smaller projects. Westinghouse said the cost per unit for three reactors may be more than 10% higher than in a case when the country chooses to build all six one by one.

Furthermore, Korea Hydro’s bid faces hurdles after Westinghouse sued the company to prevent “unauthorized” sharing of nuclear technology it first obtained from the US with other countries, such as Poland. Sasin told weekly Sieci that he got assurances from both sides of the dispute that it would end quickly. Without some sort of settlement between the two, Poland will not start the Korean project, he said. Westinghouse has so far ruled out any out-of-court settlement.

Why is Poland’s plan so complicated?

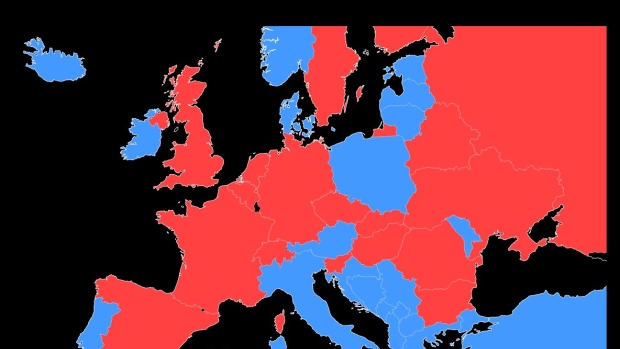

This isn’t clear. Poland’s pick of a US partner seemed a natural choice with the recent tightening of security cooperation between the NATO allies in the wake of Russia’s aggression in eastern Europe.

Officially, the government said it first needs to pick the location for the second three reactors before choosing the builder. The deal with Korea Hydro, on the other hand, is led by Polish companies, with the country’s authorities only providing support needed for a project on this scale.

Some analysts see another potential motive: Poland may be effectively stringing along Korea Hydro and EdF for the second three-reactor deal -- as well as starting a separate project with the Koreans -- to pressure Westinghouse to complete its AP1000 reactors on time and on budget.

Are there other risks?

Yes, politics and financing. Poland’s opposition is likely to win next year’s election, according to opinion polls. Although parties in the opposition support nuclear power in principle, they may change this government’s decisions.

Also, Poland wants its foreign partner to purchase a minority stake in the project, preferably with 49% equity, although Westinghouse’s share will probably be lower. The company said that US Exim Bank and other institutions can provide more than 70% of the financing. Poland said it has $17 billion in loans ready.

Felicia Aminoff, an analyst at BloombergNEF, said that Poland should announce mechanisms to ensure “profitable, stable power prices” for nuclear energy, like the UK has done. “Building two different types of reactors simultaneously does reduce the opportunities for some economies of scale, but it’s still possible that either the Westinghouse or Korea deal will fall through,” she said. Also, “there has been no final agreement around financing” and it’s not clear if private investors would be sufficiently interested in such projects.

©2022 Bloomberg L.P.