Jun 2, 2022

How to Push Wall Street to Ditch Fossil Fuels for Clean Energy

, Bloomberg News

(Bloomberg) -- The invasion of Ukraine has put the US and Europe on a wartime mission to abandon Russian fossil fuels. This series looks at speeding up zero-carbon alternatives by lowering political and financial barriers. Sign up here to get the next story sent to your inbox.

It will cost more than the gross domestic product of the entire world to rewire the global economy to run on clean energy.

Policy makers and campaigners focused on ginning up the estimated $100 trillion needed over the next three decades know that governments alone cannot foot this bill: Wall Street must get on board with the energy transition. The odds of decarbonizing the world depend to a significant extent on bankers being swayed to direct their dollars away from fossil fuels and toward renewables.

Whether carrots or sticks, the options being considered are numerous, according to interviews with current and former bankers, nonprofits and academics. They include everything from the introduction of carbon pricing to adjusting capital rules and encouraging financing partnerships between pubic and private money. And the urgency of the conversation is only increasing as scientists warn the world is warming at an ever-quickening pace, and as the war in Ukraine underlines the dangers of reliance on fossil fuels.

“The challenge of how to incentivize the banks to transition from high carbon to green activities is really a challenge of how to incentivize the bankers,” said Rhian-Mari Thomas, a former Barclays Plc banker who is now head of the UK government-backed Green Finance Institute in London. “Changing behaviors within the financial services industry is all about people: It’s about vision, leadership and ultimately courage to give up doing the business you understand for transactions that are unfamiliar, all within a culture where success is rewarded and talent retained through the bonus pool.”

Money is the language of Big Finance, and conversing in Wall Street’s mother tongue is a must for those pitching ideas on how it can suppress emissions. Bankers’ bonuses are a function of a lender’s return on equity, a measure of profitability that itself is influenced by the revenues the bank generates and the amount of capital it is required to hold, said Thomas, who is the former global head of green banking at Barclays.

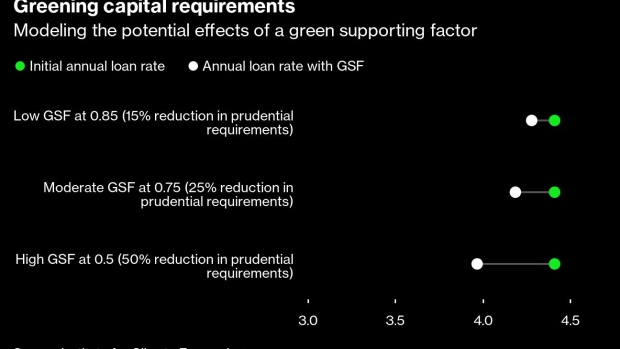

Tracing dollars and emissions upstream to capital requirements is an idea investors and regulators have bounced around for a few years, and in Thomas’ view, the rules are a potential lever that “could be impactful to change behaviors.” If banks were required to hold fewer assets against loans to green companies and projects than to fossil fuels, such lending would become more attractive. Banks have helped arrange about $175 billion in loans and bond sales for oil, gas and coal companies so far this year.

But opinion is divided. In an October report the Bank of England poured cold water on the idea of using a so-called “green supporting factor,” lowering capital requirements for certain climate-friendly investments such as energy-efficient mortgages or electric cars, and a ‘‘brown penalising factor” that would subject fossil-fuel lending to a higher capital burden. The regulatory capital framework “is not the right tool to address the causes of climate change (greenhouse gas emissions),” the report argued, and while capital requirements could be used to affect financing and investment decisions directly, they are “not likely to be effective unless calibrated at very high levels” that would result in a broad erosion of capital in the system or buildup of risk in other areas.

However, the idea remains live. Just last month the European Banking Authority asked for feedback on a new paper on “the role of environmental risks in the prudential framework,” which discusses how capital rules can or should be adjusted in light of the climate crisis.

For James Vaccaro, a former renewables banker who now leads the Climate Safe Lending Network, which seeks to align bank lending policies and actions with a future in which the rise in global temperature is kept well below 1.5 degrees Celsius, capital weights might be more effective at discouraging fossil lending than stimulating green business.

He said that although regulators would likely stop short of issuing an outright ban on banks funding the expansion of fossil fuels, they could instead require banks to hold 100% of capital against that loan instead of the typical requirement of around 8%.

“From a behavioral point of view, that really changes the dynamics for banks and feels like a poison pill on pricing,” said Vaccaro. “From a financial stability perspective, what we know is that the more we have an increase in the amount of fossil fuels, the greater the systemic risk. There can be no financial stability when there’s planetary instability.”

Read More: How to Get Clean Energy, Faster

When it comes to incentivizing lending to green projects—an area of financing that former Bank of England governor and climate finance champion Mark Carney says needs to more than double from current levels—Vaccaro suggests capital tweaks may not be the best approach. Instead he says blended finance would be a better tool for funneling large sums into renewables. Also known as de-risking, blended finance refers to an approach whereby governments sign up to take the first losses on a loan if banks agree to provide a pile of money for a deal. Blended finance was a key topic at COP26, the November 2021 United Nations climate change conference, yet few sizable deals have yet materialized.

For Rama Variankaval, global head of JPMorgan Chase & Co.’s center for carbon transition, the best way to speed up the transition would be to develop a carbon pricing system that banks can apply to their operations. “What needs to change is the relative pricing between carbon-intensive and green initiatives and the bank capital rules would naturally follow,” said New York-based Variankaval. “All of a sudden that would start to manifest in how we do credit analysis and how we evaluate green projects.”

Variankaval’s call echoes another theme of COP26 which has yet to gain traction. A global carbon price would require the will and coordination of world leaders at a time when geopolitical tensions are the highest they have been in years.

“It is hardly surprising that banks are demanding ‘carrots’ to be socially and environmentally useful in the transition,” said Agnieszka Smolenska, assistant professor at the Polish Academy of Sciences and an associate researcher for the European Banking Institute. “All the efforts following the [2008] financial crisis have not eradicated the short-termism in the financial sector.”

For Smolenska, the best solution for pushing banks to support the energy reformation could be simply requiring them to detail how they will change their operations and financing activities in line with a target of limiting global warming to 1.5°C. The UK government last year became the first to mandate companies and financial institutions in the country publish transition plans. European policy makers are discussing plans that would identify the extent to which a company’s operations impact upon and are affected by climate change, as well as requiring them to publish quantifiable targets to address any misalignment with the 1.5°C goal.

Such plans would “give meaningful teeth” to banks’ net-zero pledges and are “the most promising avenue for a long-term and forward-looking engagement of banks with the real economy with a view of achieving climate neutrality,” said Smolenska. That’s in no small part because banks with transition plans that are viewed to fall short of the required standard may face additional capital requirements and more regulatory interventions, she said.

©2022 Bloomberg L.P.