May 23, 2022

HSBC’s Major Says Inflation Wrong-Footed Wall Street on Yields

, Bloomberg News

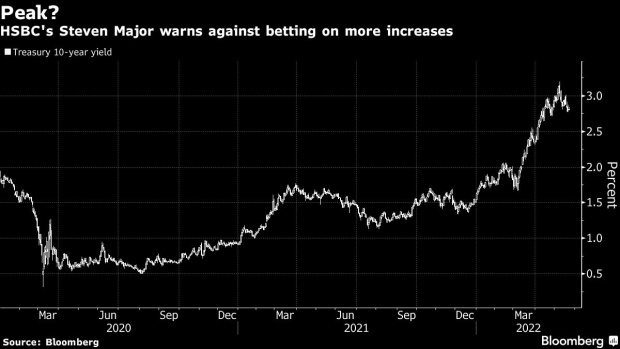

(Bloomberg) -- The worst may be over for US bonds after a breakneck surge in yields.

That’s the take from long-time bond bull Steven Major of HSBC Holdings Plc, who says investors should ignore consensus forecasts for higher rates, given history shows their track record hasn’t been good. Indeed, investors and analysts alike have been wrong-footed by the recent rally in bonds. With the inflation trajectory remaining uncertain, other metrics like degree of losses and forecast history may be of more value now, he adds.

“The bond market has just gone through something not dissimilar to previous record selloffs,” said Major. “There will never be a single indicator that tells the whole story, but looking at where the forecasting error sits relative to previous times of change might make a few investors think twice about positioning for still higher yields.”

The problem with forecasts is that consensus views often don’t differ much from where the market prices yields -- which is strongly influenced by current rates and trends, according to Major. Sticking closely to forwards, means there’s a so-called “recency bias” to predictions that combines with a natural tendency for investors to be risk-averse and avoid deviating from views of the masses, he added.

Currently forward markets see the 10-year US Treasury yield at about 3% in one year’s time. The median forecast of strategists and economists surveyed by Bloomberg News put the yield at about 3.15%. The 10-year yield traded at 2.85% on Monday. Major’s forecast for the yield is for it to fall to 2.5% by the end of the second-quarter 2022. Major’s forecast for the yield is for it to fall to 2.25% by the end of the second-quarter 2023.

The close link of forward rates, which are derived from the shape of the yield curve, and consensus forecasts are an ideal way to track forecasting error, according to HSBC. And the currency yields in the marketplace are very elevated relative to what was expected a year ago, with this measure about as high as it’s been for the last 20 years, Major says. Analysis of these errors through time shows “the market is not much good at forecasting higher yields and far worse at predicting lower yields.”

“Inflation has been the key driver” to errors over the last year, Major said. “More persistent than many of us thought possible, it is the main reason yields are so much higher than most forecasters expected one year ago. We were too slow to adjust our yield forecasts to the rapid increase in inflation, underestimating both how high and sticky it was going to be.”

US government bonds already lost 8% this year through the end of last week, putting them on course for their first back-to-back annual declines in at least five decades, according to a Bloomberg index. A global gauge is down 11.6%. Those losses have been tempered over the past week as spiraling share prices sparked haven demand that brought the benchmark 10-year US Treasury yield down over 30 basis points since hitting 3.2% on May 9 -- its highest since 2018.

Read more: A 60% Drop for World’s Longest Bonds Shatters Wall Street Models

(Updates 10-year yield.)

©2022 Bloomberg L.P.