Feb 14, 2023

Illinois Faces Hurdles Steering Budget to Navigate a Recession

, Bloomberg News

(Bloomberg) -- Illinois, back from the brink of a junk rating, faces more challenges than other US states maneuvering its budget to weather an impending recession.

Governor J.B. Pritzker, the billionaire Democrat who was reelected in November, will deliver the first state of the state and budget address of his second term on Wednesday. Investors in the lowest-rated US state said they want to know how he plans to prepare for the expected economic slowdown that risks dimming the outlook for the coming fiscal year.

Illinois won a string of upgrades from the three major credit raters starting in mid-2021, which pulled it back from the verge of a non-investment grade rating. Its revenue topped forecasts, and general funds through the first seven months of fiscal 2023 beat the same stretch in the prior year by almost $2 billion. The state used some of that cash to build up its rainy-day fund, pay back pandemic-era federal loans, and put more into its underfunded pensions.

But in a recession, the state may not be able to adjust its budget as flexibly as other US states, said Ty Schoback, a senior analyst for Columbia Threadneedle Investments, which owns Illinois debt as part of $14 billion in muni assets.

“Reasons why Illinois continues to be the lowest-rated state is less budget resiliency for a recession compared to other — higher-rated — US states,” he said. “This takes the form of longer track records of fiscal prudence, higher budget reserve build-ups, and better funded pension funds which have a better ability to absorb the impact of a recession to capital market valuations.”

Exceeding Forecasts

In November, the Governor’s Office of Management and Budget estimated that the state’s fiscal 2023 general funds net surplus would reach almost $1.7 billion, as income and sales tax collections exceeded previous forecasts. As part of that five-year forecast, the budget office also projected a $357 million surplus in fiscal 2024.

At the time, Pritzker had recommended depositing $1.3 billion of the fiscal 2023 surplus into the rainy-day fund, bringing it to more than $2.3 billion. He also suggested using part of the surplus to pay off some of the revenue bonds issued in 2010 to help pay bills from the Great Recession.

“The Governor has restored fiscal stability to the state over the past four balanced budgets and will continue that fiscal progress this year,” Jordan Abudayyeh, a Pritzker spokesperson, said in an emailed statement.

All these steps taken by the state had been rewarded by analysts, investors and rating firms.

“They have been in a positive trend the last few years with pension funding and credit ratings,” said Daniel Solender, a partner and director of tax-free fixed income for Lord Abbett & Co., which owns Illinois debt as part of $30 billion in muni assets. “It’s making sure they are focusing on continuing the positive trend.”

On Wednesday, Fitch Ratings will be listening for Illinois officials’ underlying economic assumptions for revenue, said Eric Kim, an analyst for the rating firm. Fitch also will look for signals about any significant changes in terms of progress and policy for pensions and education, in case revenue begins to fall short, he said.

Fitch, in May 2022, had bumped up Illinois’s bonds by two notches, the firm’s first upgrade for the state’s general obligation bonds since June 2000. Illinois has been upgraded by the two other large credit-rating firms since mid-2021 as well. The state’s rating is still the lowest among its peers, largely because of its pension liability.

Read more: Illinois Curtails Debt Plan With Yield Spike Countering Upgrades

“That is the heaviest millstone around their neck,” Columbia Threadneedle Investment’s Schoback said. “They’ve done a lot of great things but there’s still room to continue to climb the credit quality ladder. The market has rewarded them with lower cost of capital, but they continue, unfortunately, to be the lowest-rated state in the country by more than one notch.”

Illinois’s 10-year spread over benchmark AAA bonds had ballooned to 4.4% at the height of the pandemic and then narrowed to about 53 basis points in December 2021, the lowest since at least 2013, according to data compiled by Bloomberg. The spread this week is hovering close to 133 basis points.

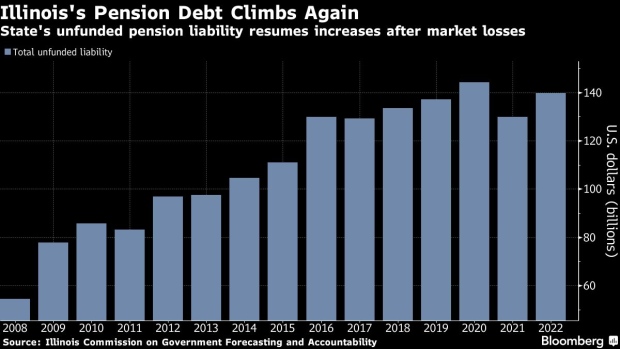

Pension Liability

The unfunded pension liability across Illinois’s five retirement systems rose 7.5% to $139.7 billion in the fiscal year that ended in June, based on the market value of their assets, according to the Illinois Commission on Government Forecasting and Accountability. That’s a shift from 2021, when pension debt dropped as stock prices rallied.

Pritzker’s speech also may touch on other challenges in the state, including rising crime, declining population and its business climate. The state has seen headquarter departures of well-known, large companies including Boeing Co., Caterpillar Inc. and Citadel, billionaire Ken Griffin’s hedge fund.

Read More: Chicago Is Seeking Its Own Jamie Dimon After Griffin’s Exit

The Illinois General Assembly will debate appropriations over the next several months and vote on the budget, likely before the end of June.

John Miller, head of municipals at Nuveen, which holds Illinois debt, said investors are looking for increases in the state’s reserves and pension funding, along with expected allocations to education, universal preschool and childcare next year.

“Investors want to see Illinois adopt another responsible budget based on conservative revenue projections for” fiscal 2024, Miller said in an email. “Illinois’ elevated fixed cost burden remains a challenge, holding the credit back and limiting budgetary flexibility.”

©2023 Bloomberg L.P.