Mar 15, 2019

India Sensex Set for Best Week Since November as Foreigners Buy

, Bloomberg News

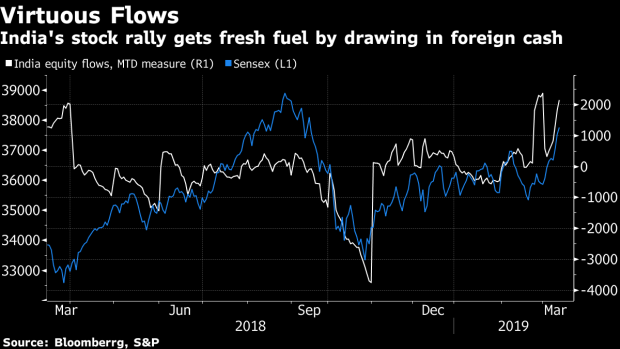

(Bloomberg) -- India’s benchmark index extended gains in its best week in more than four months as foreign investors poured funds into equities.

The S&P BSE Sensex added 0.7 percent to 38,017.01 as of 10:01 a.m. in Mumbai, taking its advance this week to 3.6 percent. The NSE Nifty 50 Index also climbed 0.7 percent.

Overseas investors bought $2.2 billion of stocks through March 13, almost matching purchases for the whole of February. Net buying is headed for the biggest two-month inflows in two years.

Strategist View

“Foreign inflows have helped keep up market momentum and there are now gains on the table for local investors to pick up,” said Jitendra Panda, managing director at Peerless Securities Ltd. in Kolkata.

The Numbers

- Sixteen of 19 sub-indexes compiled by BSE Ltd. advanced, paced by a gauge of banking stocks

- Kotak Mahindra Bank Ltd. contributed the most to index advance, increasing 4.3 percent. ICICI Bank rose 1.8 percent, while State Bank of India gained 2.1 percent

- Hindustan Unilever was the biggest drag on the index, declining 1.7 percent. Coal India was down 1.1 percent

- 3i Infotech Ltd. climbed as much as 10% on news report Samara Capital in talks to buy company

Analyst Notes/Market-Related Stories

- Religare Gains After Report Singh Brothers Ordered to Repay Co.

--With assistance from Garfield Reynolds.

To contact the reporter on this story: Nupur Acharya in Mumbai at nacharya7@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Margo Towie, Ashutosh Joshi

©2019 Bloomberg L.P.