Oct 6, 2022

Investors Take a Long-Term Bet on Vietnam’s Cheap Valuations

, Bloomberg News

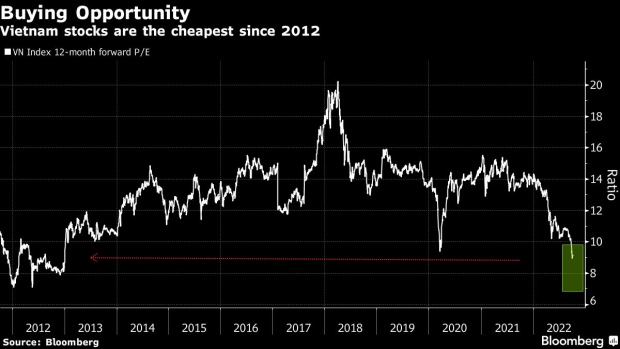

(Bloomberg) -- Vietnam’s stocks benchmark is the worst performer in Southeast Asia so far this year, but fund managers are betting on a rebound as valuations dive to a decade-low.

The Vietnam Stock Index has fallen more than 27% this year as concerns grow over rising interest rates. The gauge now trades at about 9 times estimated earnings over the next year, its lowest since 2012, prompting firms such as Coeli Asset Management SA to increase their positions in Vietnam.

“There are a lot of high quality companies with fantastic structural growth opportunities trading over a standard deviation below their historical averages. It’s a great time to buy,” said Coeli Asset fund manager James Bannan, whose fund remains “flat” this year in US dollar terms.

Read: Vietnam Is Among World’s Most Oversold Stock Markets: Chart

Vietnam stocks are ripe for a short-term rebound after a selloff that started in late August. Even so, investors will keep a close eye on the market “to see if the bear is still strong or if we are reaching the bottom,”said Quynh Cao, director of institutional sales at SSI Securities Corp.

Investors said Vietnam’s long-term story remains intact due to its stronger macroeconomic position relative to regional peers. The country, whose economy is expected to grow about 7% this year, is also a prime beneficiary of supply chain shifts.

“Vietnam remains our top country pick,” said Asia Frontier Capital Ltd.’s Hong Kong-based fund manager Ruchir Desai, who helps oversee $87 million worth of assets in Vietnam and other markets such as Bangladesh, Pakistan and Sri Lanka.

Read: Vietnam Economy Posts Double-Digit Growth on Manufacturing

©2022 Bloomberg L.P.