May 4, 2021

IPOs Boom at the Fastest Pace Since 2007 in Australia

, Bloomberg News

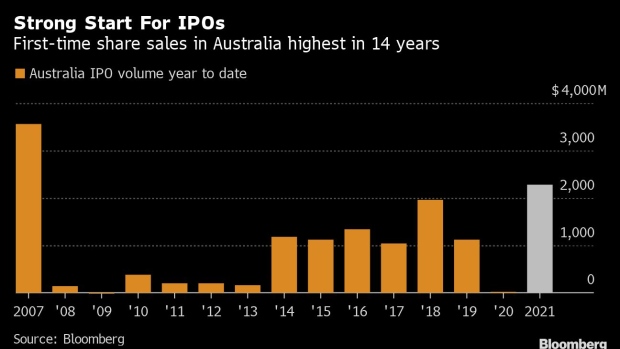

(Bloomberg) -- From hospitals to pubs, Australian companies are rushing into public markets to raise funds via first-time share sales at the fastest pace in 14 years.

Australian companies have priced nearly $2.3 billion of initial public offerings so far in 2021, the most year-to-date since the $3.6 billion raised in 2007, according to data compiled by Bloomberg. More than half of this year’s haul came from four IPOs, which fixed the prices of their respective offerings in the past two weeks.

Read More: KKR-Backed Pub Firm, Healthcare Group Join Australia’s IPO Rush

The companies come from a diverse range of industries, underscoring rising optimism that the effects of the Covid-19 crisis on Australian businesses are diminishing.

On Monday, private hospital firm Aurora Healthcare Australia Ltd. and Australian Venue Co., a pub operator backed by KKR & Co., launched offerings looking to raise nearly $600 million combined. KKR is also majority owner of non-bank lender Pepper Money Ltd., which began marketing its IPO on April 29 to raise A$450 million ($349 million).

“We’re 12 months on from Covid and 12-month returns are pretty healthy for all participants in the market,” said Andrew King, a portfolio manager at Perennial Value Management. “People are probably thinking, ‘I might cycle out of my stocks that are up 80% and into a new IPO,’ as long as they offer a compelling proposition that is relatively attractively priced.”

To be sure, the class of 2021 has a lot of ground to cover before it begins to rival the annual record of $15.8 billion that Australian companies raised in 2014.

Other listings in the pipeline include discount clothing retailer Best & Less Group, which had underwriters send out research to prospective investors in the business last week.

A number of Australian corporations are also weighing options for divisions that could end up with public offerings. Betting business Tabcorp Holdings Ltd. is conducting a strategic review of its wagering and media arm that may lead to a de-merger, and Link Administration Holdings Ltd. is exploring both a potential trade sale and an IPO of its electronic conveyancing arm Pexa. Australia’s biggest retailer Woolworths Group Ltd. has told investors it is considering a separation of its pubs and liquor-store business Endeavour Group.

©2021 Bloomberg L.P.