May 17, 2022

It’s Not Clear If Fed Will Have to Induce a Recession to Control Inflation, Official Says

, Bloomberg News

(Bloomberg) -- The Federal Reserve official who has long been the central bank’s most dovish policy maker said it’s an open question whether he and his colleagues will have to induce a recession to bring inflation down.

“My colleagues and I are going to do what we need to do to bring the economy back into balance,” Minneapolis Fed President Neel Kashkari said Tuesday during a town hall event in Sault Ste. Marie, Michigan.

“What a lot of economists are scratching their heads and wondering about is: If we really have to bring demand down to get inflation in check, is that going to put the economy into recession? And we don’t know.”

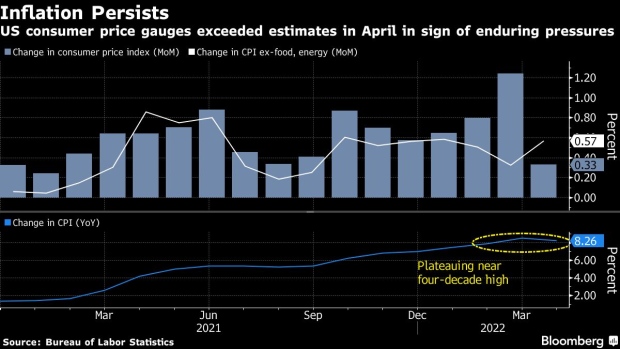

Kashkari’s comments underscore the unity among Fed officials in their goal of bringing inflation down. US consumer prices rose 8.3% in the 12 months through April, according to Labor Department figures published May 11. That was slightly lower than the 8.5% increase in the 12 months through March, which marked the highest inflation rate in 40 years.

“Before the pandemic hit, it was easy for me to be a quote-unquote dove,” Kashkari said, referring to the low-unemployment, low-inflation economic environment that prevailed at the end of the last expansion. “Now, it’s easy to be a hawk, because inflation is so out of whack, and by any measure, the labor market is strong.”

After keeping its benchmark interest rate pinned at nearly zero for two years, the central bank’s policy-making Federal Open Market Committee voted in March to raise the rate by a quarter-percentage point. The FOMC followed it up with a half-point hike earlier this month, and Fed Chair Jerome Powell told reporters that it was on track for two more half-point increases in June and July.

The Minneapolis Fed chief said central bankers might have to examine the trade-offs involved in inducing a recession if they felt it necessary to get inflation under control, given their dual mandate of promoting both maximum employment and price stability.

“One would look at, theoretically, hey, what would a recession do to the unemployment rate?” Kashkari said.

“So, if the recession is effective in bringing inflation down, but then you’re pushing the unemployment rate way up, now all of a sudden you might be moving from one type of imbalance to the opposite type of imbalance. Like any kind of system, you want to avoid over-correcting if you can.”

(Updates with more Kashkari comment)

©2022 Bloomberg L.P.