Jun 27, 2023

Japan Bank CEOs Are Paid a Fraction of What Global Rivals Make

, Bloomberg News

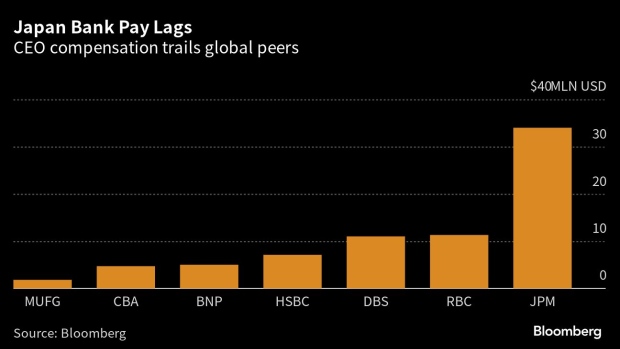

(Bloomberg) -- The chief executive officers of Japan’s deal-hungry megabanks are earning a fraction of their global peers, showing how the nation still frowns upon outsized pay packages even with profits forecast near a record.

Mitsubishi UFJ Financial Group Inc. CEO Hironori Kamezawa’s total compensation was 257 million yen ($1.8 million) for the year ended in March, including stock awards, according to a filing by Japan’s largest bank. Sumitomo Mitsui Financial Group Inc. CEO Jun Ohta received a total of 186 million yen, while Mizuho Financial Group Inc.’s chief Masahiro Kihara was paid 146 million yen.

The size of their paychecks is dwarfed by compensation in the US and other major markets. JPMorgan Chase & Co. CEO Jamie Dimon was paid $34.5 million last year, while HSBC Holdings Plc CEO Noel Quinn took home $7.1 million. In Singapore, DBS Group Holdings Ltd.’s Piyush Gupta was awarded about $11 million.

The Japanese banks’ relatively meager pay came after they posted some of the highest profits in recent years and embarked on a string of deals to beef up their presence across Wall Street. Culture plays a role in Japan, as lenders tend to be viewed as semi-public entities, while the infusion of government funds during the nation’s financial crisis in the late 1990s has left its mark.

Japanese companies have traditionally taken a view that compensation is a reward for having successfully risen through the ranks in an organization, said Takaaki Kushige, senior director at the Japanese unit of Willis Towers Watson. In the US and elsewhere, the paycheck often reflects their performance as leaders through profits and share prices, he said.

In Asia, executives at Chinese banks, some of the world’s biggest, also earn a fraction of their global peers.

“There are some Japanese companies which have started revamping their corporate governance and raising top management compensation to the levels of the US and Europe,” said Kushige. “But it will take time for all to catch up since this is an issue rooted in entrenched views.”

©2023 Bloomberg L.P.