Feb 26, 2024

Japan’s Inflation Tops Forecasts, Supporting BOJ Rate Hike Bets

, Bloomberg News

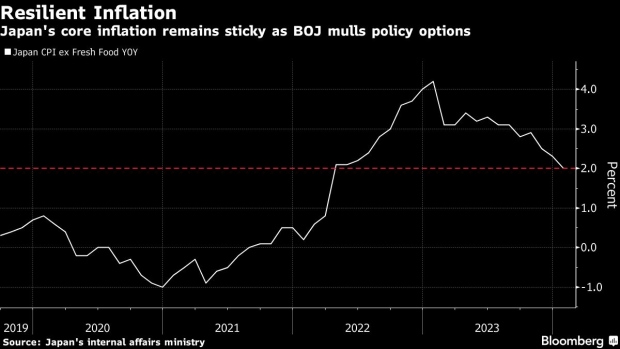

(Bloomberg) -- Japan’s benchmark inflation topped estimates in January, supporting the case for the central bank to scrap its negative interest rate in the coming months.

Bond yields jumped after consumer prices excluding fresh food rose 2% from a year ago, in line with the Bank of Japan’s inflation target. The two-year note yield climbed to the highest level since 2011 after the data from the internal affairs ministry Tuesday exceeded a consensus estimate of 1.9%.

“The report is adding to speculation that the BOJ will end negative-rate policy as early as March and is serving as a selling catalyst for bonds,” said Kazuya Fujiwara, a fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo. The January CPI report underscores persistent inflationary pressures, he said.

The stickier-than-expected inflation data will sustain market speculation that the BOJ is nearing its first interest rate hike since 2007, a move that a majority of central bank watchers expects to happen by April. Japan bank shares extended gains on expectations of greater profitability.

The yen also strengthened a tad after the inflation print, while overnight-indexed swaps now indicate greater certainty that the BOJ will abolish its subzero rate policy by June.

“Today’s data are supportive of BOJ’s normalization in coming months,” said Koya Miyamae, a senior economist at SMBC Nikko Securities. “The bank is stepping closer to its price target. It was good for the bank that it didn’t fall below 2% even due to a special factor.”

One of the main factors that helped inflation outpace forecasts was a 63% jump in the price of foreign travel packages. While the cheap yen is attracting a flood of tourists coming into Japan, it’s also pushing up the costs of travel abroad by Japanese.

Governor Kazuo Ueda signaled confidence over the prospects for anchoring inflation above 2%, saying last week he expects a virtuous economic cycle of prices, wages and employment to strengthen.

Inflation readings are expected to rebound in February as the impact of government price relief measures fades in year-on-year comparisons. Those measures were equivalent to a percentage point drag on overall inflation when they were first introduced last year.

The median estimate of 25 economists surveyed by Bloomberg indicates core inflation excluding fresh food will average 2.4% in the first and second quarters of 2024.

The core rate is likely to jump above 2.5% in February, according to Miyamae.

What Bloomberg Economics Says...

“The BOJ, which has geared up its communications in preparation for an exit from negative rates, will probably welcome this news. Even so, the CPI report adds to mixed readings on the economy.”

— Taro Kimura, economist

For the full report, click here

It was the 22nd straight month in which inflation matched or exceeded the BOJ’s target. A gauge of inflation that excludes fresh food and energy prices, a key indicator for underlying price trends, also beat consensus, rising 3.5%. Economists had estimated it would rise 3.3%. Growth in services slowed to 2.2%.

Still, current economic fundamentals warrant careful communication by the BOJ if it chooses to start raising interest rates. The economy slipped into a technical recession at the end of last year as consumers and businesses cut spending. Wage growth has lagged behind inflation, putting pressure on household budgets. That partly explains why Prime Minister Fumio Kishida’s support has sagged.

The yen trading around multi-decade lows versus the dollar may also revive import-driven inflation and hurt consumption further down the line. The weak currency has helped send Japanese stocks to a record high thanks to strong demand from overseas investors, but it’s not boosting sentiment in Japan. Japanese individuals have tended not to invest in stocks as actively as peers in other developed economies.

Tuesday’s report showed prices for electricity and gas fell by more than 20% in January from a year earlier. Government subsidies for electricity and gas continued to shave 0.48 percentage point off the overall inflation figure.

Prices of processed food, which had been a key inflation driver, gained 5.9%, slowing from 6.2% in December. Prices for lodging increased by 27%, slowing from 59%.

Economists and investors will closely monitor Tokyo inflation figures for February due next week. Those figures will give the first indication of how much price growth will climb after the initial impact of subsidies falls out of calculations and could further fuel near-term rate hike expectations.

--With assistance from Keiko Ujikane and Masaki Kondo.

(Adds bond market reaction in second paragraph, quote in third paragraph.)

©2024 Bloomberg L.P.