Dec 21, 2022

Japan Swaps Signal Yields to Break BOJ’s New Ceiling: In Charts

, Bloomberg News

(Bloomberg) -- The Bank of Japan’s shock decision to tweak its yield-curve control ceiling has boosted policy-normalization bets, fueled expectations for higher and more volatile yields and may also damp demand for US Treasuries.

1. Faster Normalization

Overnight indexed swaps are factoring in a steeper policy rate path to levels above 0.4% by October next year. That compares with pricing for 0.2% before Tuesday’s BOJ decision:

2. Higher Yields

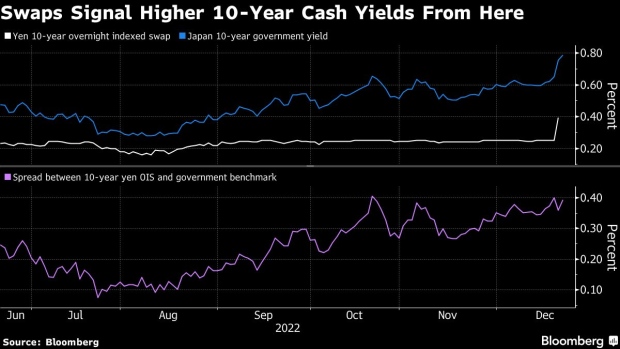

Japan’s 10-year swap rate has risen to almost 0.8%, underscoring expectations from traders for the benchmark cash yield to eventually rise even beyond its current 0.45% level:

3. Further Volatility

Implied volatility on the nation’s 10-year interest-rate swaps over a six-month period has soared to the highest since December 2010 following the decision, signaling that investors are bracing for more market turbulence:

4. Demand for Treasuries

Rising yields on Japanese government bonds may boost their allure relative to Treasuries. In recent sessions, US notes have fallen, pushing rates on the securities higher, in tandem with a strengthening yen — suggesting bets on repatriation flows:

©2022 Bloomberg L.P.