Nov 24, 2022

JPMorgan Asset Picks Industrials to Ride Rally in Japan Stocks

, Bloomberg News

(Bloomberg) -- JPMorgan Asset Management’s Japan equity fund is betting on undervalued industrial-related shares to shine amid a potential market rally driven by a weakening yen, rising capital expenditures and improving corporate earnings.

The $459 million JPM The Japan fund is bullish on companies such as machinery maker IHI Corp. and infrastructure firm JGC Holdings Corp., Daisuke Nakayama, a fund manager at the firm, said in an interview. The fund has returned 3.2% this year, beating 80% of its peers, according to data compiled by Bloomberg. Japan’s benchmark Topix Index is up 1.3% for 2022, while the Nikkei 225 is down 1.4%.

Nakayama’s upbeat view comes as Japan has proved to be one of the most resilient developed equity markets during this year’s global rout, with the Bank of Japan’s dovish stance making it an outlier among major central banks. The MSCI World Index of developed-market shares has lost 17% year-to-date, heading for its worst annual loss since 2008.

While Japan’s monetary easing led to a tech boom and coincided with a decline in the relative importance of capital investment over past decades, funds may “flow back from the digital names to the real economy,” Nakayama said. “The strong performance of Japan’s fundamentals is coming back to its historical high since the 1990s.”

The capital goods and services sector, which makes up a large number of value stocks, accounts for 8.5% of the S&P 500 Index. In comparison, the sector accounts for 24% of the Topix index. That could provide a tailwind for Japanese shares, according to Nakayama.

JPMorgan Asset’s fund has a bottom-up strategy, choosing companies with potential for high profit growth and a focus on shareholder value, Nakayama said. Game maker Sega Sammy Holdings Inc., lender Resona Holdings Inc. and cable maker SWCC Showa Holdings Co. are also some of its top picks.

Other analysts have also expressed optimism over the economy. Norihiro Yamaguchi, a senior economist at Oxford Economics, wrote in a note that the economy should stay relatively resilient amid pent-up demand, a recovery in the auto industry, supportive monetary policy and a strong base effect. Junichi Makino, the chief economist at SMBC Nikko Securities, expects the economy’s recovery to accelerate on the nation’s strong purchasing power, waning Covid impact, stimulus measures and better terms of trade, according to a note.

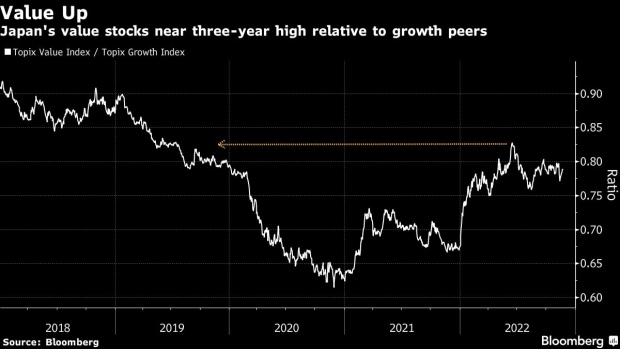

As fundamentals improve, the stock market will reach a turning point where money may flow back into industrial-related names that have been undervalued, said Nakayama, who looks at trends over a 10- to 15-year period. Value stocks are holding near a three-year high relative to growth shares, according to gauges that track the Topix shares.

©2022 Bloomberg L.P.