Jul 11, 2022

JPMorgan’s Kolanovic Hedges Risk-On Wager, Cuts Corporate Debt

, Bloomberg News

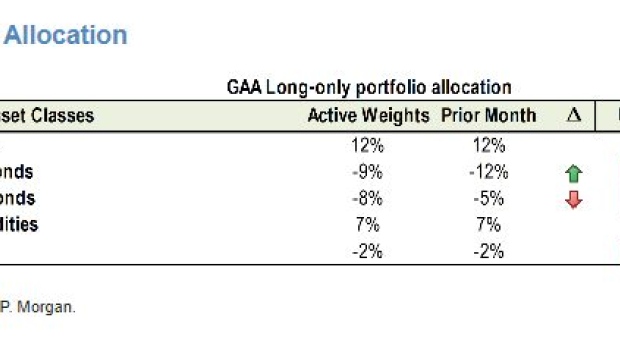

(Bloomberg) -- JPMorgan Chase & Co. strategists led by Marko Kolanovic advised investors to further cut holdings in corporate debt while reducing underweight positions in bonds, in what amounts to a softening in their broad risk-on stance.

While staying upbeat about a second-half rebound in stocks and commodities, the strategists reduced their credit exposure as a “partial hedge in an adverse scenario.” The revision also reflects a view that corporate bonds have yet to price in as much recession risk as assets like equities.

“Markets’ pricing of recession risk intensified over the past month; however, this risk is priced unevenly across asset classes, with much higher risks priced in equities than bonds,” the strategists wrote in a note late Monday. “With most investors positioning for a recession and sentiment extremely weak, if an economic disaster doesn’t materialize we believe risky assets can substantially recover.”

Kolanovic, voted the No. 1 equity-linked strategist in last year’s Institutional Investor survey, has been one of Wall Street’s staunchest bulls, sticking to calls for risky assets all year despite a relentless equity selloff. The strategists remain underweight government bonds.

The team is still optimistic that the global economy is on course for an acceleration, led by China, and central banks will ease their hawkish stance amid moderating inflation. Friday’s data on monthly US payrolls is the latest evidence that all the recession fears are premature, the strategists posit.

Stocks have sold off in recent weeks along with commodities while traders sought safety in government bonds and US dollar amid growing concern that the global economy could slip into a recession.

While a strong advocate for value stocks, Kolanovic now sees a short-term window for beaten-down growth shares to rebound as a pause in the bond selloff gives the rate-sensitive group breathing room. Based on price-sales ratios, unprofitable tech stocks are now close to what he calls “outright cheap territory.”

“The upward repricing of bond yields was a constraint for the valuations of the long duration part of the market, but that could temporarily ease,” he wrote. “Many growth groups’ valuation metrics have moderated.”

©2022 Bloomberg L.P.