Jan 14, 2024

KKR, Bain Capital Plow Into Asia Data Centers on AI, Cloud Boom

, Bloomberg News

(Bloomberg) -- Asia is becoming the latest hunting ground for global investors in data centers, as companies from KKR & Co. to Bain Capital bet on the region’s growing computing and data storage needs following an artificial intelligence boom.

Like in the US, Asia is seeing a surge in demand for data centers as giants like Amazon.com Inc. and Alphabet Inc.’s Google boost cloud services, the recent generative AI wave fuels data and capacity requirements, and the region’s growing population spurs storage needs.

Demand in Southeast Asia and North Asia is expected to expand about 25% a year through 2028, according to Cushman & Wakefield data. That compares with 14% a year in the US.

“It’s the US first and then the trend tends to follow soon after into Europe and with a little time lag into Asia Pacific,” said Udhay Mathialagan, global head of Brookfield Asset Management Ltd.’s data center business. While it’s a diverse region, the one thing in common in Asia is that everyone is online, he said. “You need phenomenal amounts of connectivity and really good data centers.”

Investors have already made moves. Bain Capital announced a deal in August to take Beijing-based data center business Chindata Group Holdings private with an implied equity value of $3.2 billion. In September, KKR & Co. agreed to acquire a 20% stake in Singapore Telecommunications Ltd.’s regional data center business for about $800 million. Blackstone Inc. announced the launch of its first wholly owned data center platform in Asia in November 2022.

Including the Singtel platform, KKR sees the potential to invest $1 billion in equity on data center projects in the Asia-Pacific region in coming years, said Projesh Banerjea, the firm’s director of infrastructure. Returns for such investments are in line with targets for KKR’s infrastructure strategy, which are in the mid-to-high teens, he said in an interview.

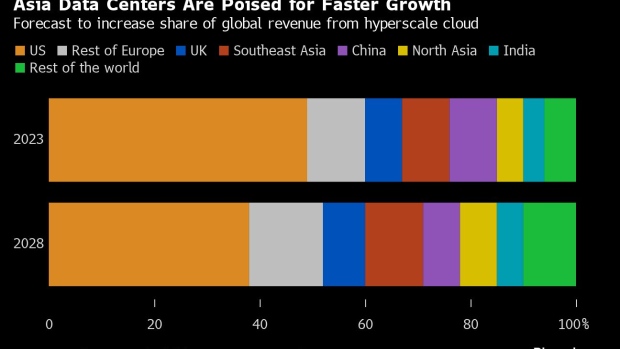

The bet is that Asia will eventually provide a bigger slice of the pie. About 29% of so-called hyperscale cloud revenue — used in the industry as a proxy for market growth — is generated from Asia Pacific versus 49% from the US, according to Cushman & Wakefield. By 2028, Asia’s share is expected to increase to as much as 33%, or $173 billion.

“This is a super-easy investment story,” said Morgan Laughlin, global head of data center investments at PGIM. “You have demand, which is growing with no end in sight, and you’ve got supply becoming increasingly constrained with no solution in sight.”

PGIM plans to invest as much as $3 billion in the global data center sector over the next three years, including in major Asia-Pacific markets, said Laughlin. The company has been negotiating for sites in Tokyo and Seoul, according to a person familiar with the matter. PGIM declined to reveal the location.

Bain Capital will continue to invest in China and Southeast Asian markets, as well as look for opportunities in developed regions elsewhere in Asia, Jonathan Zhu, partner and co-head of the firm’s Asia private equity business, said by email.

“Driven by cloud and AI, the entire Asia market will continue to grow,” Zhu said. That will “ramp up the competition for assets and resources.”

There are challenges. Data center development is time-consuming and complex — requiring a mix of expertise around real estate, technology, local regulations and environmental requirements. Asia’s highly fragmented market makes navigating these factors even more onerous.

“There is no such thing as one Asia, and each country has its own regulations, so we see more single-country operators than pan-regional ones,” said Ellen Ng, co-head of Asia real estate at Warburg Pincus. “Being able to offer products and services across multiple markets in Asia is important to users, so investors and operators try to crack this.”

China has proposed easing cross-border data controls after tightening its grip in recent years, although rules there remain vague. Singapore authorities lifted a moratorium on data center construction in 2022 but remain selective about awarding projects, investors interviewed said, and the country has published standards for operators to ensure energy efficiency.

Warburg Pincus, through its portfolio Princeton Digital Group, has a presence in six markets and is looking for opportunities in existing and new locations, Ng said. As part of its ESG strategy, it has also expanded to Malaysia’s Johor and Batam in Indonesia to serve Singapore as the city-state imports most of its energy and has fewer renewable power options. Warburg’s investment in the sector in Asia has totaled almost $1 billion, she said.

Data centers are also racing to improve their cooling systems, which have come under pressure from increased use of graphics processing units to handle a surge in complex computation demands from areas such as AI. GPUs consume more power and emit more heat than central processing units, the primary component of computing engines.

In October, a fault in the cooling system of data center operator Equinix Inc. affected 2.5 million payment and ATM transactions of DBS Group Holdings Ltd. and Citigroup Inc. DBS, Singapore’s largest bank, was later banned from acquiring new business ventures for six months. Singapore’s government also said it will study how to further strengthen the security and resilience of data centers.

“Risk-wise, government regulations around data privacy, national data sovereignty and sustainability are building out across most markets,” said Glen Duncan, Asia-Pacific director of data center research at Jones Lang LaSalle Inc. “If investors and operators don’t keep abreast of the changes, they can become wrong-footed.”

(Updates with Warburg’s total investment in the 15th paragraph)

©2024 Bloomberg L.P.