Nov 1, 2022

Korea Credit Crisis Spreads as Bond Uncalled in First Since 2009

, Bloomberg News

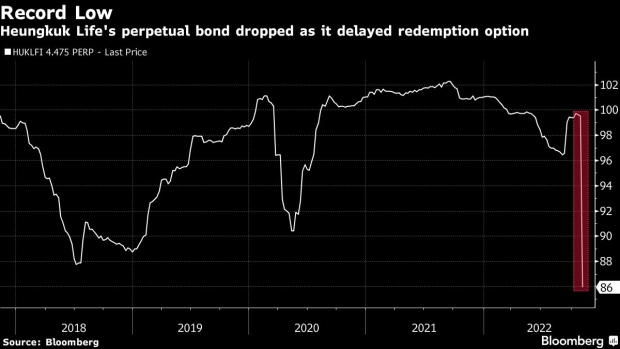

(Bloomberg) -- A South Korean insurer took the unusual step of delaying buying back perpetual bonds, in the first such case for the nation’s issuers since 2009 that adds to signs of a crisis in the local credit market.

Heungkuk Life Insurance Co. will postpone exercising a Nov. 9 call option for its dollar perpetual note, citing market conditions that prompted it to delay a planned security issuance that would have repaid the bonds, a spokesman said. It plans to exercise the call option, which it can do once every six months, in the future after issuing dollar securities.

Korea has been scrambling to prevent a credit market meltdown from sparking broader contagion, after local corporate bonds suffered one of the most rapid selloffs ever in the past three months. Things worsened after a rare default on commercial paper by the developer of the Legoland Korea theme park in late September. The broader selloff has been one of the worst in Asia’s local-currency markets amid a global fixed-income slump this year.

In a particularly alarming development, yields on local commercial paper that companies use to raise funds for short-term payments like payroll have surged to a 13-year high. Meanwhile, spreads on won corporate notes have risen to the highest since at least 2010. Korea’s offshore bonds, which had been considered a relatively safe bet in Asia, are also seeing a widening in yield premiums.

Korea’s credit market turmoil is continuing even after authorities jumped into action to try to nip it in the bud. They’ve unveiled a 50 trillion won ($35 billion) aid package for credit markets, while the Bank of Korea is expanding the range of bonds it will accept as collateral. And the banking regulator said last week that financial institutions will start paying 3 trillion won into a fund to stabilize credit markets.

Still, there haven’t been extensive defaults yet in Korea’s credit market after the developer’s nonpayment. The absolute yield levels in Korea are still lower than many other countries, and selloffs in some other dollar bond markets globally have been even more abrupt recently.

The price of Heungkuk Life’s $500 million securities, rated Baa3 by Moody’s Investors Service and BBB- by Fitch Ratings, fell to a record low on Tuesday after investors were notified that the redemption will be postponed, Bloomberg-compiled data show. Investors usually assume that bonds like those will be called at the first available opportunity, so a delay in buying back the debt tends to hurt its price.

Financial authorities in Korea were aware of Heungkuk’s plan to skip the call option and they viewed the decision as rational considering various conditions, the Financial Services Commission said in a statement Wednesday. Heungkuk Life doesn’t have any problem with its financial health, the FSC said, adding that authorities will monitor the market situation after the delay in exercising the call option.

No Korean issuer has delayed exercising a bond repayment option since Woori Bank postponed buying back its subordinated note in 2009. It’s an unusual occurrence globally that can cause shocks in the market as happened when Spanish lender Banco Santander SA skipped a call option in 2019.

(Updates with Korea financial regulator’s statement.)

©2022 Bloomberg L.P.