Oct 31, 2022

Korea Exports Post First Fall in 2 Years as Economy Sputters

, Bloomberg News

(Bloomberg) -- South Korea’s first decline in exports in two years is among the clearest signals yet that the global economy is cooling under the pressure of rising interest rates.

Working-day shipments on average declined 7.9% in October from a year earlier, customs office data showed Tuesday. Headline exports dropped 5.7%, worse than estimates for a 2.1% fall.

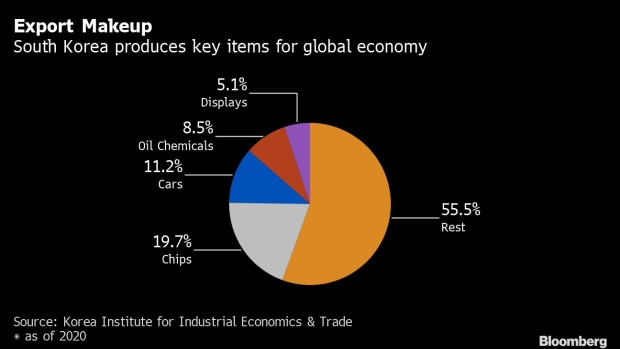

Korea’s trade performance is a canary in the global coal mine as the country manufactures key items such as chips, displays and refined oil for the world economy. The data showed semiconductor exports, Korea’s biggest source of income, dropped the most since 2019, while shipments to China contracted by double-digits for the first time since the onset of the pandemic.

“It’s an early indicator that is signaling demand is slowing in the global economy,” said Roh Hyun-woo, a strategist at Hanwha Asset Management. “Interest rates are rising, credit markets are strained and sentiment is weakening and exports reflect those trends.”

Overall imports gained 9.9%, resulting in a trade deficit of $6.7 billion, the nation’s seventh consecutive monthly shortfall. The deficit was almost double the $3.5 billion expected by economists.

Deteriorating exports and mounting trade deficits are among the latest concerns for policy makers who are struggling to maintain economic momentum. A deadly crowd crush during weekend Halloween celebrations in Seoul is set to add to factors weighing on the economy as it’s likely to hurt consumer sentiment.

A credit rout triggered by the default of a local developer also chilled investor sentiment, prompting the government to pledge 50 trillion won ($35 billion) in financial support. Economic growth decelerated last quarter as inflation remained elevated and the central bank stepped up policy tightening.

High global commodity prices are raising the prospect of Korea’s first annual trade deficit since the global financial crisis. The won’s slide against the dollar is likely to cause a decline not only in imports but also exports going forward, according to the Korea Development Institute.

Russia’s war on Ukraine, monetary tightening in major countries and a global slowdown are among factors driving the drop in exports, the trade ministry said in a statement. It also pointed to slowing exports and rising deficits in other manufacturing powerhouses such as Germany, France and Japan.

The report from the trade ministry showed:

- Exports to China fell 15.7%, while total semiconductor shipments slid 17.4%

- Total automobile shipments advanced 28.5% in October from a year earlier, while exports of oil products rose 7.6%. Korea sold 16.7% more rechargeable batteries than a year earlier.

- Overall exports to the U.S. gained 6.6%, while those to Japan decreased 13.1% and to the European Union were up 10.3%.

(Updates with comments from economist and trade ministry.)

©2022 Bloomberg L.P.