May 9, 2022

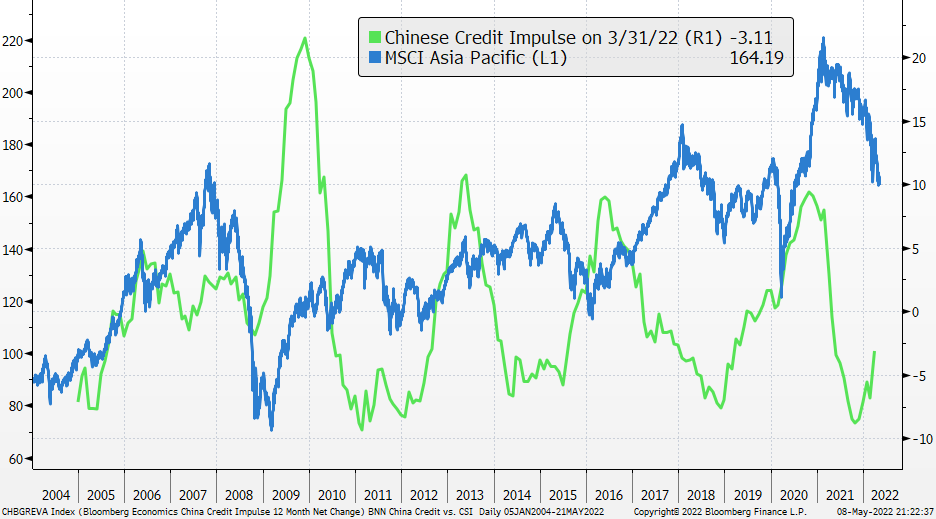

Larry Berman: Can China's credit impulse turn the trend?

By Larry Berman

Larry Berman takes your questions

Chinese Premier Li Keqiang warned of a “complicated and grave” employment situation as Beijing and Shanghai tightened curbs to help contain COVID. At the same time, we expect the Chinese central bank to cut the medium-term lending rate this week. Historically, a strong credit expansion in China is bullish for Asian equities and generally positive for global gross domestic product. Not necessarily immediately, but eventually. We see this in our first chart this week that the Chinese credit impulse indicator can be a leading indicator for Pan-Asian equities. Of note, the impulse index is still contracting (year-over-year< zero), but has turned up in recent months. With the five year Party Congress in October, Beijing will likely pull all the punches to make sure there is plenty of liquidity in the system offsetting the current COVID surge. This should provide some stability for markets in the coming months. Asian markets have already moved back to pre-COVID levels on the current decline, suggesting some of the best relative values compared to U.S. markets. Betting on China has been tough in recent months to be sure and we were early here.

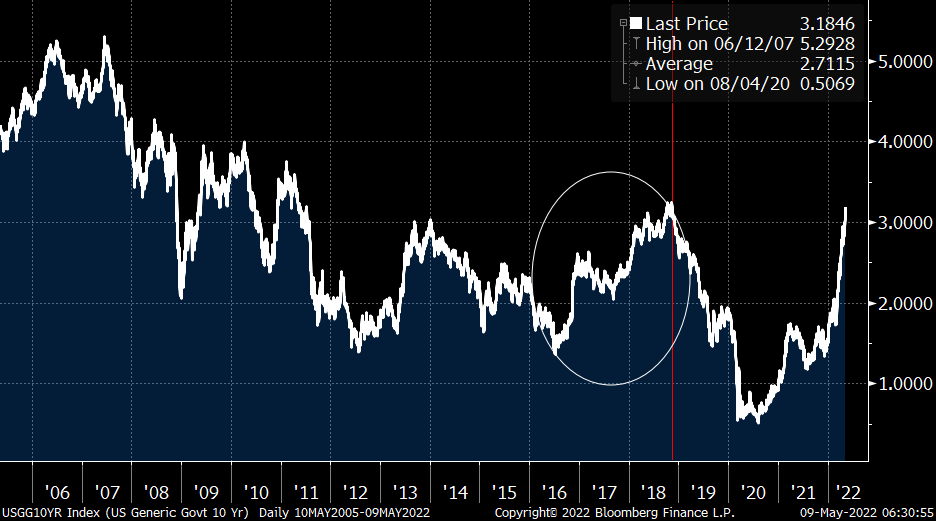

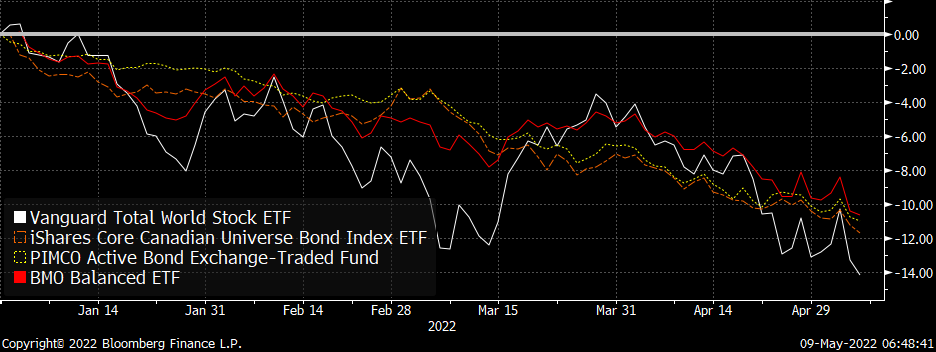

The catalyst this week for a turn in markets could be a peak of inflation expectations with U.S. consumer price index (11th) and producer price index (12th) while the U.S. 10-year yield is threatening a break of the 2018 peak around 3.25 per cent seen prior to the Powell pivot and the S&P 500’s 2018 -20 per cent bear swoon. There is not likely to be a pivot anytime soon and why there could be a bit more pain for the traditional 60:40 balanced portfolio where bonds have offered no protection this year. Several Wall Street strategists are starting to talk about a recession risk and are lowering their yearend targets.

If you have learned a few things over the years from our educational segments, please consider supporting one of my favourite charities. Dementia and Alzheimer’s research at the Baycrest Hospital/Rotman Research Institute is world class. Each year I raise money for this cause and match BNN viewer donations. In the past nine years we have raised almost $500,000 thanks to you. Please consider sponsoring here. This is the final week for this year’s event. Thanks to all that have donated this year.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com