Jan 11, 2021

Larry Berman: Speculation in call volume hits all-time extremes

By Larry Berman

Speculation in call volume hits all-time extremes: Larry Berman

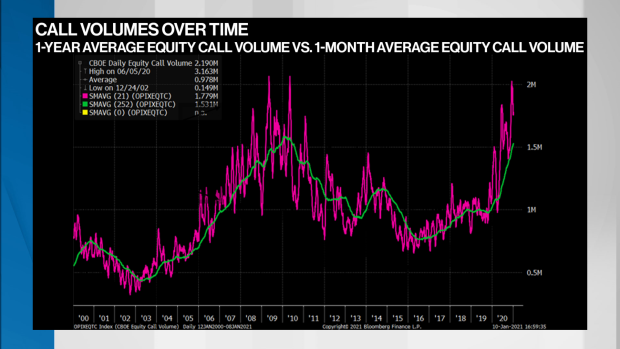

With options expiring this week, we wanted to have a look at the impact it’s having on markets. It’s huge. In the past week we have seen all-time call volume records challenged (viewers can follow the CBOE data here). It seems the new stimulus cheques are finding their way into Tesla Inc. call options and others. Speculators have had a voracious appetite (call it FOMO plus leverage) and they have been using call spreads and other speculative strategies to add huge leverage. This effect gets magnified around options expiry dates.

The math of options trading can be tricky. There are all sorts of information on the internet about it. With earnings season starting this week, many will use options to speculate on outcomes. We can use JPMorgan Chase & Co. as an example that is reporting earnings this week on (options expiry) Friday. In its simplest form, the buyer of the call option (the speculator) thinks JPMorgan will report an upside surprise. A look at the chart of JPMorgan shows the pre-COVID (all-time) high is US$141.10 (Jan. 2, 2020). It closed at US$136.02 Friday. A US$137 call traded at US$1.92 on Friday and the US$141 call traded at US$0.83. So, a US$137-141 call spread would cost about US$1.10 (range might be as much as US$1.15) depending on a few factors. If you believe the stock will trade to US$141 on a positive surprise, you could limit your risk to US$1.15 and have a potential profit of US$4.00 (US$141-137). For options trades, we generally like to see at least a 3:1 ratio or higher.

Here is where the leverage comes in to play. Let’s say you buy 10 options (100 shares per) which controls 1,000 shares of JPMorgan US$136 x 1,000=US$136,000 in value). The cost of the trade is US$1.10 x 100=US$1,100. So for a grand, you control huge leverage. The seller of the option (hedger) would have to buy the delta to offset the position.

| CONTRACT | DELTA | POSITION | POS DELTA |

|---|---|---|---|

| Buy JPM 1/15/21 137C | 0.421 | 10 |

421 |

| Sell JPM 1/15/21 137C | 0.158 | -10 | -158 |

| Total Hedge Delta | 263 |

The hedger would need to buy 263 shares to hedge your US$1,100 trade. So the value of the hedge is US$136 x 263=US$35,768. Here’s where the math gets tricky and interesting: As investors buy calls, the hedger buys the underlying stock pushing up its price. Let’s say that pushes the price up to US$138. The delta hedge is now 317 shares and an additional 54 shares would need to be bought. This is the gamma effect. It’s the rate of change in the delta. So as leverage is added (by way of call speculation) the hedge amount goes up.

| CONTRACT | DELTA | POSITION | POS DELTA |

|---|---|---|---|

| Buy JPM 1/15/21 137C | 0.594 | 10 | 594 |

|

Sell JPM 1/15/21 141C |

0.277 | -10 | -277 |

| Total Hedge Delta | 317 |

On Friday, the options expire. Let’s say JPMorgan is right at US$141. The call spread owner buys one side at US$137 and sells the other at US$141 and cash settles for the US$4 profit. It’s a win for the speculator. At US$141, the delta hedge is 0.5 or 500 shares. That now needs to be sold by the hedger as the options expire. This is why options expiry days are potential turning points with big volume for stocks with speculation as a growing part of the investor base.

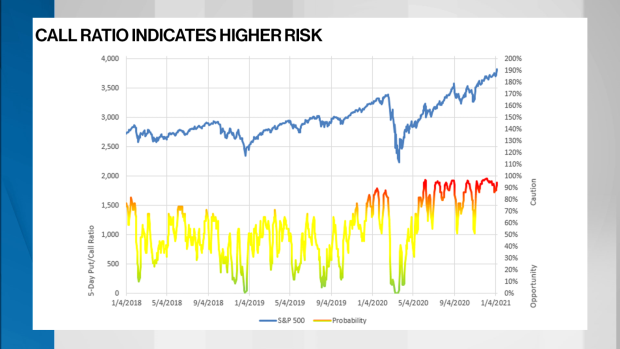

Historically, the put/call ratio is more helpful at market lows. Market highs are a very different sentiment and behaviour. What it tells us is the degree of leverage and speculation in the market is a notable risk, but cannot be timed with precision. Usually, it needs an exogenous event to trigger and unwind the leverage. The interesting part of delta and gamma analysis is that it gets magnified as well on the way down as more put options buying begets more hedgers having to delta sell short stocks. For now, this is a notable risk factor and suggests that we should not be chasing the market higher (unless of course you are a speculator).

Look for more in the coming weeks from our new Berman’s Call Probable Return on Investment Index, PRO-II (pronounced Pro Eyes) Indicator. We will be launching the new website later this month so that BNN Bloomberg viewers can follow along with the various risk and opportunity factors we follow.

Subscribe to my new YouTube channel Larry Berman Official which is the new site for all our educational content, my new weekly market recap, and ETF bull and bear picks of the week. Look for a series of option-based educational videos in 2021.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com