Nov 18, 2019

Larry Berman: The risk-return of the gold sector in 2020

By Larry Berman

Berman: Why should you own gold?

When evaluating investment opportunities, I always look at both the potential return of being right and the risk of being wrong. Far too many people consider only the upside and not the downside.

While gold bullion is not technically fixed income in that it does not pay a yield — and gold equities are certainly not fixed income, either — its behaviour as an asset class is more like fixed income than it is like equity. But in most cases, gold just does its own thing, and for that reason it’s an extremely attractive asset class. Let’s explore.

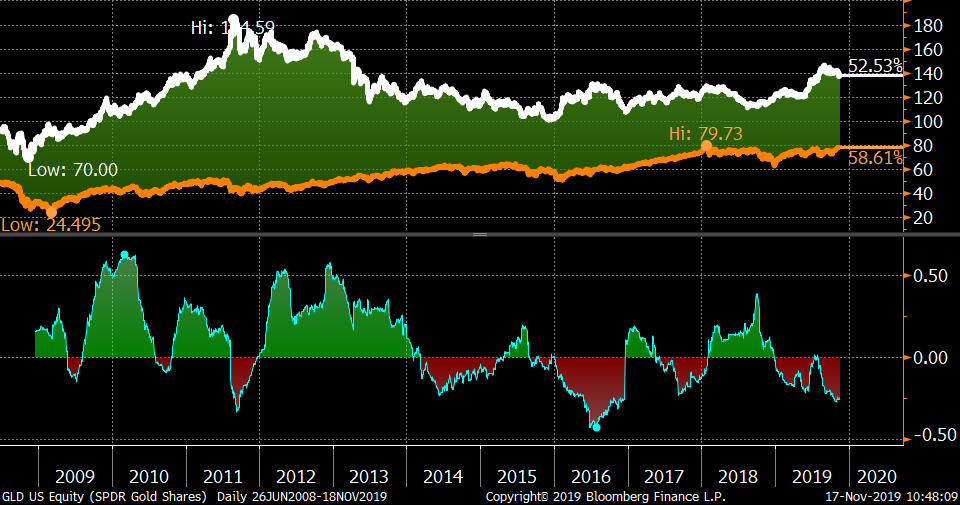

Correlation Gold Bullion (GLD) vs. (VT) FSTE Total World Stock ETF

The long-term correlation between gold bullion to equities is sometimes positive, sometimes negative, but generally very low. That makes it an asset class you want in your portfolio.

Correlation Gold Bullion (GLD) vs. (AGG) US Total Bond Market

The correlation to bonds is similar, in a way: Sometimes positive, sometimes negative, but mostly low. The major trouble with gold versus stocks and bonds is that it has no real (after inflation) yield (dividend or interest). But when bonds and equities have a negative real return, gold is even more important as an asset class and diversifier in portfolios. On the Sept. 24, 2018 episode of Berman’s Call, I highlighted our very bullish view on gold and gold equities. I showed this relative value chart, below (now updated), that points to extremely low valuations of gold equities relative to bullion.

S&P TSX Gold Index vs. (GLD) Gold Bullion

So how do we position in an asset class that has clearly shown resistance to the next tier of breakouts (above US$1,550) that would take it to the previous high (US$1,921), and at the same time could fall back to test the breakout (US$1,375) levels? Options.

A long straddle or strangle is a bet that volatility expands, but you are not sure of the direction. This makes the most sense when volatility is cheap. A put spread is a long position closer to the money (current price) and a short position farther out of the money. A ratio put spread is best used to buy a dip with a better risk-return profile.

With a January 15, 2021 strike date that takes us through the U.S. election, the following prices are seen for options on gold bullion (GLD:US) and gold equities (GDX:US). We want to express a bullish position on the gold market. We see major support between US$23-US$25 for GDX and US$128-US$132 for GLD. We are buyers in these ranges.

The potential breakout for gold bullion is significant. We could see GDX hitting US$40, which is a 50-per-cent return from current levels, but we could also see a test of the breakouts to the downside should markets continue their excitement over a U.S.-China trade deal and an equity-friendly FOMC.

| GDX US$26.74 | GDX Option | GLD US$138.25 | GLD Option |

|---|---|---|---|

| Buy 1x US$27 Call | US$3.35 | Buy 1x US$138 Put | US$6.00 |

| Sell 2x US$24 Put | US$1.71 x 2 = US$3.42 | Sell 2x US$132 Put | US$3.05 x 2 = US$6.10 |

When using options, you always want to own the position. At current levels, risk-versus-return analysis is attractive, as is owning exposure on an outright basis. But we can improve on this analysis and for us, we always want to make bets where risk-versus-return characteristics are maximized by taking a “what if we are wrong” before a “what if we are right” focus.

You can always go long and put in a 10-per-cent downside stop, but what a gold VIX of 10 per cent tells you, in addition to the low expectation of volatility, is that simple noise can take you out. And besides, if you like the risk here, why wouldn’t you like it closer to the breakout levels? You would if you are a value investor like me and don’t like the risk-reward and whipsaw of chasing trends.

We are in the closing stretch of my current roadshow (Fixing Fixed Income). Bond yields are likely to remain low for many reasons, including global demographics and the massive existing debt burden. As we age, we need our money to last longer, and low real interest rates are a huge tax on incomes. And while rising stock markets help, they only really help the top third of the population that benefits from exposure. So the average person is doing okay, but the median person is increasingly worse off. The bottom half of people have little to no impact on the wealth effect, but are hurt most from low rates in retirement. The safe bond part of your portfolio is broken, perhaps permanently impaired. You will need to learn to get creative to enhance your real return on your fixed income, and gold is part of how you can improve your portfolio.

Register free at www.etfcm.com and make your donation here.

| Market | Date |

|---|---|

| Markham | Sunday, November 24, 2019 |

| Victoria | Wednesday, November 27, 2019 |

| Langley | Thursday, November 28, 2019 |

| Vancouver | Saturday, November 30, 2019 |

Twitter: @LarryBermanETF

LinkedIn: ETF Capital Management

Facebook: ETF Capital Management

Website: www.etfcm.com