Apr 28, 2023

Lazard to Cut Workforce 10% as CEO Predicts Slump Through 2023

, Bloomberg News

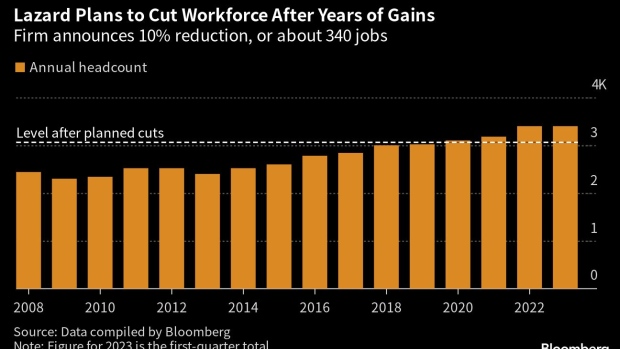

(Bloomberg) -- Lazard Ltd. posted a surprise loss for the first quarter and said it plans to reduce its workforce by 10% this year, predicting the industry’s dealmaking slump will last through 2023.

“Candidly, things are not feeling as good as they were in December or January,” Chief Executive Officer Ken Jacobs said in a telephone interview Friday. “It’s time to act. That’s basically it.”

Investment-banking fees across the five biggest Wall Street banks plummeted 49% last year, according to Bloomberg Intelligence, as Russia’s invasion of Ukraine roiled markets and damped corporate confidence. The Federal Reserve’s aggressive push to contain inflation by raising interest rates has also been crimping capital-markets activity.

At the same time, wages surged on Wall Street in recent years as junior bankers demanded higher salaries and senior bankers benefited from an industry boom. Even amid the current downturn, wages remain sticky, Jacobs said, while costs tied to travel, entertainment and information services have soared. The CEO said he believes his competitors will also be cutting jobs as the dealmaking environment remains muted.

Many top banks have already started. Citigroup Inc. has eliminated hundreds of jobs across the company, amounting to less than 1% of the workforce. JPMorgan Chase & Co., the biggest US bank, has cut hundreds of mortgage employees, and Goldman Sachs Group Inc. embarked on one of its biggest rounds of job reductions ever in January, when it planned to erase thousands of positions across the company.

At Lazard, with roughly 3,400 employees as of the end of March, the announcement signals about 340 jobs will be lost. The move cost $21 million in the first quarter, according to a statement Friday, and the company said it anticipates an additional $95 million in charges.

Shares of the company declined 3.8% to $31.09 at 9:54 a.m. in New York, extending this year’s drop to 10%.

Read more: Lazard Posts Surprise Loss as Slow M&A Hits Revenue

Lazard’s first-quarter financial-advisory revenue slumped 29% from a year earlier, to $274 million, and fell short of the $296 million estimate in a survey of analysts by Bloomberg News. Asset-management revenue of $265 million was down 15%.

The adjusted loss per share was 26 cents, compared with an average estimate of 30 cents of profit per share.

Many of the firm’s costs are hard to trim, Jacobs said. “You can’t lower salaries easily, as we are price takers on travel and entertainment,” he said. “It’s very difficult to lower salaries, especially in an environment when you have inflation going on all around you.”

(Updates with other firms’ cuts in fifth paragraph, stock reaction in seventh. A previous version of this story was corrected to remove a reference to missed estimates.)

©2023 Bloomberg L.P.