Feb 23, 2023

Lucid, Nikola and Lordstown Motors Miss EV Goals by Big Margins

, Bloomberg News

(Bloomberg) -- Last year was a forgettable one for Lucid Group Inc., Nikola Corp. and Lordstown Motors Corp.

The three electric-vehicle startups that went public by merging with special purpose acquisition companies all came up well short of their original goals for 2022.

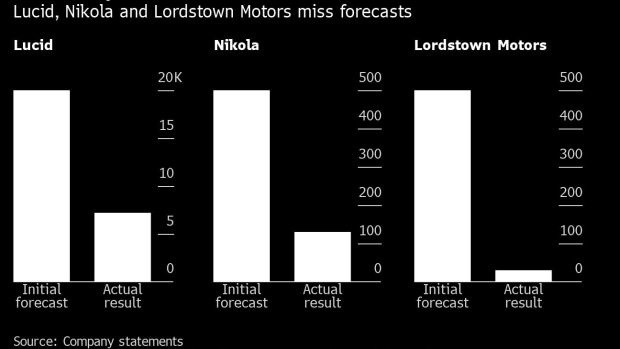

Lucid and Lordstown Motors each missed their production objectives by wide margins, with Lucid making only slightly more than a third of its plan, at 7,180 Air sedans for the year, and Lordstown Motors building 31 Endurance pickups, a fraction of the 500 it had in mind.

Nikola delivered 131 Tre heavy-duty trucks, about a quarter of the number it had initially hoped to hand over to customers. The company cut its delivery forecast twice last year, and still fell short of the 300 it predicted in November.

The outlook for 2023 isn’t much brighter.

Lucid’s shares tumbled after it forecast production of only up to 14,000 vehicles this year. Nikola’s stock fell after the company said it expects to deliver only as many as 375 trucks. And Lordstown Motors shares plunged after the manufacturer announced it had paused production and customer deliveries since January due to performance and quality issues.

Lucid plummeted as much as 19%, Lordstown slumped as much as 15% and Nikola declined as much as 9% as of 12:01 p.m. Thursday in New York trading.

--With assistance from Ed Ludlow, Sean O'Kane and David Welch.

©2023 Bloomberg L.P.