Jul 8, 2020

M&A Leveraged Loan Pricing Establishes a Covid-Era New Normal

, Bloomberg News

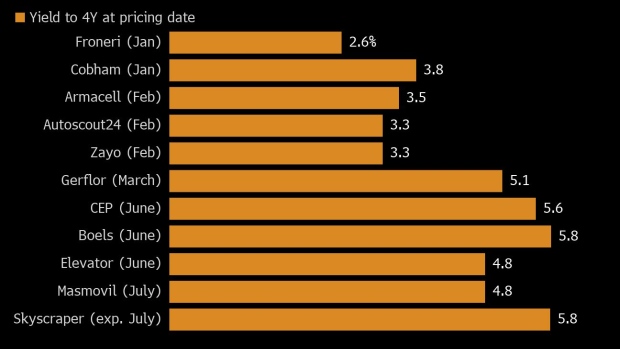

(Bloomberg) -- A consensus is forming on how much companies should pay to raise leveraged loans for M&A in Europe, after a cluster of deals including jumbos for Masmovil Ibercom SA and ThyssenKrupp Elevator.

That will help underwriting banks price their next deals as M&A discussions ramp up again following the dislocation of the second quarter.

M&A loans are more richly-priced than the ultra-cheap debt available before the Covid pandemic struck. Borrowers coming to market in the last few weeks are paying margins in the mid- to high-400 basis points with discounts to par of two to three points.

In January, margins were often below 400 basis points and many deals priced at par. But the new levels aren’t so rich as to make funding for new buyouts unfeasibly expensive--as long as the credit story is sound, says a banker who’s pitching for fresh M&A and asked not to be identified.

Those from tougher sectors are offering extra, for example construction chemicals firm Skyscraper Performance. That loan, which is yet to be finalized, lines up with Boels Verhuur NV from early June. But whereas Boels had to pay up despite carrying double-B ratings, Skyscraper is solidly in the single-B camp, indicating that pricing has come down in the past month.

The loan market won’t necessarily suit all borrowers, however: companies rated B3/B- may turn to direct lenders or the bond market for M&A funding. That’s because CLOs, which make up about half of Europe’s loan buyer base, want better-rated credits to balance out the slew of Covid-related downgrades.

(Ruth McGavin is a leveraged finance strategist who writes for Bloomberg. This analysis and her observations is her own and not intended as investment advice.)

©2020 Bloomberg L.P.