Feb 16, 2022

Macau Casino Stock Rally Points to Risky Bet on China Ending Covid Zero

, Bloomberg News

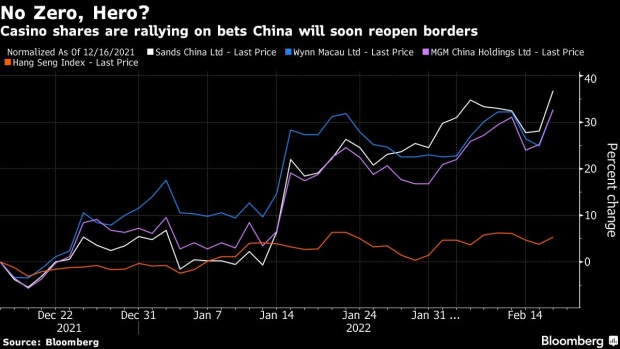

(Bloomberg) -- If there was ever a binary trade in China, it’s on whether the country will wind down Covid Zero and reopen its borders. A rally in Macau casino stocks shows some investors are betting that may happen soon, despite plenty of evidence to the contrary.

A gauge of Macau casino operators surged 5.6% on Wednesday in one of its biggest gains in months. Sands China rallied 6.8% to a five-month high, while Wynn Macau climbed 6.3%. A surge in derivatives trading suggests speculative activity, with Sands China options volume more than double the 20-day average. A bullish contract that profits if the stock gains about 15% by next week rallied 1,000%.

China’s surprise decision over the weekend to clear Pfizer Inc.’s coronavirus pill for use is being taken a sign that the government may be getting closer to pivoting away from its Covid Zero policy. Bets on reopening have turned the country’s Big Three airlines into some of the top performers on the mainland bourses this year.

Casino shares have been buoyant since Macau’s government released its long-awaited gaming bill in mid-January, removing a key overhang. Under the bill, Macau plans to grant a maximum of six casino licenses with a duration of 10 years and an option for a three-year extension. The new rules permit the six existing casino license holders to hold their positions when their rights expire in June.

One contrarian theory notes that Hong Kong’s worsening outbreak could be a catalyst for China to change its Covid Zero stance in the second half, Jefferies strategists wrote in a recent note -- before Xi demanded the city do everything to bring infections under control. Hong Kong could be seen as a successful test case if the government manages to keep mortality low, they wrote, and the WHO could give China “an out” by starting to declare the end of the pandemic.

“Investors need to be positioned for a possible China “U turn” on Covid,” wrote Jefferies equity strategists including Simon Powell. “While this analyst remains cautious on a China opens sooner scenario, investors need to be careful not to be on the wrong side of a more rapid reopening.”

To be clear, there is little evidence that Beijing will shift to a more relaxed approach to the virus any time soon, even as countries from the U.S. to Australia wind down pandemic restrictions. Hong Kong is being forced to try and eliminate the virus which is only widening exponentially.

S&P Global Ratings analysts aren’t optimistic, cutting Las Vegas Sands -- the majority owner of Sands China -- to junk on Wednesday. The analysts also said it was too difficult to conclude whether China will maintain its Covid Zero policies throughout the year.

“We believe that the resumption of travel between Macau and Mainland China in 2022 will be slower than we initially anticipated,” S&P analysts Melissa Long and Ariel Silverberg wrote.

©2022 Bloomberg L.P.