May 22, 2019

Markets Shrug Off May’s Brexit Offer

, Bloomberg News

(Bloomberg) -- It’s not going to be the big game changer after all.

That’s the conclusion of investors and analysts after U.K. Prime Minister Theresa May made a final play to persuade members of Parliament to vote for her Brexit deal. While she promised to give them a vote on a second referendum predicated on their support for the the accord, politicians from pro-Brexit Conservative MPs to the opposition swiftly came out against the latest plan.

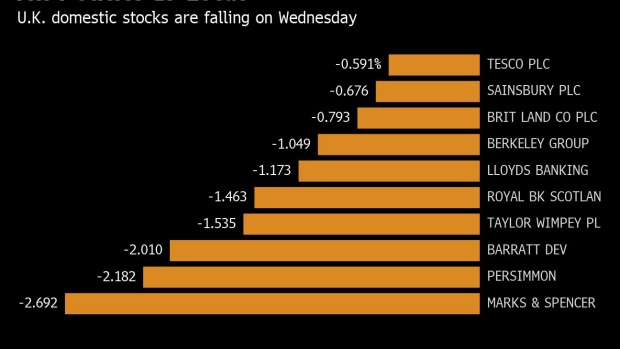

Markets reacted the same way. The pound quickly reversed its initial jump and was down 0.3% as of 8:41 a.m. in London, helping the overseas-oriented FTSE 100 outshine Europe with a 0.4% gain. Domestic stocks from J Sainsbury Plc to Barratt Developments Plc fell, after a rally toward Tuesday’s close.

“Theresa May’s plan doesn’t make any difference at all,” said Michael Hewson, chief market analyst at CMC Markets UK. “It’s like respraying a battered old car and trying to pretend it’s a new one. As soon as you drive off in it, you find out that it’s still the same old rubbish.”

Domestic companies of various stripes were hit on Wednesday -- some for idiosyncratic reasons, but for many, it was a reversal of the late-Tuesday rally:

For investors, the calculus has hardly changed. On one hand, markets’ worst-case scenario -- a no-deal Brexit -- remains highly unlikely, but on the other, uncertainty over Brexit’s path forward continues to hang over U.K. assets, especially as May’s days as Prime Minister look numbered.

“By now, her authority is so eroded that her latest attempt to finally resolve Brexit will likely fail,” Kallum Pickering, a senior economist at Berenberg, wrote in a note. “Instead, her proposal will probably extend the infighting in Parliament that has led to the Brexit impasse in the first place.”

There’s also the possibility of an early general election, which adds another complication to investment decisions in the U.K., given Labour leader Jeremy Corbyn’s anti-business slant.

“We maintain our view that the deal will fail, May will be replaced over the summer and her successor will probably be unable to deliver Brexit with or without a deal either -- leaving a general election later this year or in early 2020 as the most likely outcome,” Citigroup Inc. economist Christian Schulz wrote in a note.

--With assistance from Ksenia Galouchko.

To contact the reporter on this story: Justina Lee in London at jlee1489@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, John Viljoen, Jon Menon

©2019 Bloomberg L.P.