Nov 16, 2022

Micron Says Outlook for 2023 Has Weakened; Shares Tumble

, Bloomberg News

(Bloomberg) -- Micron Technology Inc. said it’s reducing production of DRAM and NAND wafers by about 20% compared with the fiscal fourth quarter “in response to market conditions.”

“Recently, the market outlook for calendar 2023 has weakened,” Micron said in a statement on Wednesday. The company said year-on-year DRAM bit supply will need to shrink and NAND bit supply growth will need to be significantly lower than previous estimates.

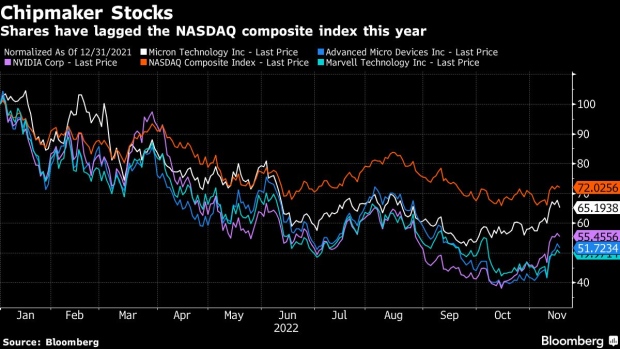

The leading US maker of memory semiconductors said it’s also working toward additional capital spending cuts. In September, the company said it would cut spending by 30% in its fiscal year. The shares tumbled as much as 4.8% as trading got underway in New York, dragging down Nvidia Corp. and Advanced Micro Devices Inc. as well.

“Micron is taking bold and aggressive steps to reduce bit supply growth to limit the size of our inventory,” Chief Executive Officer Sanjay Mehrotra said. “We will continue to monitor industry conditions and make further adjustments as needed.”

Global chipmakers had been riding high during the pandemic, when the work-from-home trend fueled demand for computers and other consumer technology. But inflation and recession fears -- plus a return to the office -- have put a damper on purchases. That’s left memory customers sitting on stockpiles of unused chips.

In the past several weeks, almost every major memory chipmaker has warned of a supply glut and tumbling prices, announcing it was time to slash capital spending. In its latest financial statement, Micron reported downbeat earnings and forecast quarterly sales that were almost $2 billion below Wall Street estimates. The company said then it expects sales of about $4.25 billion in its fiscal first quarter, which ends in November.

Memory chips are unique in the semiconductor field in that they’re built to industry standards, meaning products from rival companies are interchangeable. They’re traded like commodities, with publicly available pricing.

(Updates shares in third paragraph)

©2022 Bloomberg L.P.