Mar 25, 2020

Mike Philbrick's Top Picks: March 25, 2020

BNN Bloomberg

Full episode: Market Call for Wednesday, March 25, 2020

Mike Philbrick, portfolio manager at ReSolve Asset Management

Focus: Exchange-traded funds

MARKET OUTLOOK

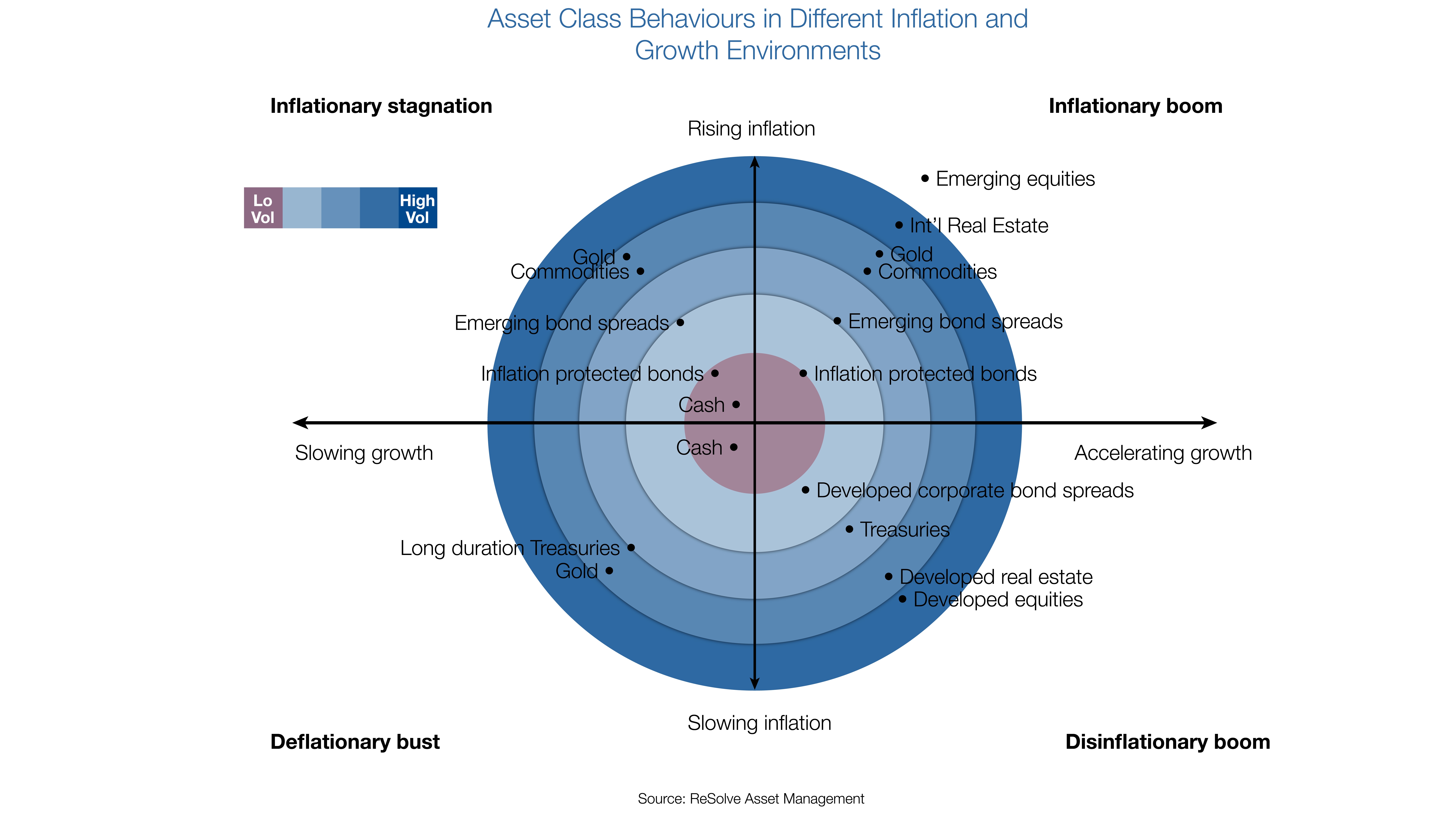

The four economic regimes created by variations in growth and inflation greatly inform whether specific asset classes will thrive or wilt. The below image illustrates the framework showing which asset classes might be expected to thrive under differing conditions. Assets toward the middle are least sensitive, while assets toward the edge of the diagram are most sensitive to each regime.

Having moved with extreme speed toward a bear market, one of the only ways to protect portfolios was to prepare rather than predict. We have both growth and inflation shocks, putting us in the lower left corner of the illustration: A deflationary bust.

The simple idea here is two-fold. First, using more diverse asset classes is an important starting point. You should be considering all the asset classes above so you own assets that have the potential to respond positively as regimes shift through time. Secondly, diversified portfolios ought to have a method to balance the risk allocated to each of these four potential states of the world. That way, an investor would never be caught off guard by a systemic “shock.”

The past quarter-century has been characterized by benign inflation and sustained growth in the global economy and it appears that a paradigm shift has occurred. These qualities favoured traditional portfolios of developed market stocks and bonds, such as the ubiquitous 60/40 “balanced” portfolio. Along with heavy credit exposures, these are showing their vulnerabilities.

Truly diversified portfolios must be prepared to weather periods of poor global growth, potentially accompanied by large swings in inflation, when both stocks and bonds may flounder. The 1970s offer a meaningful case study, as stagnating economic growth coupled with high and accelerating inflation produced negative real returns for stocks and bonds. However, holding gold, commodities and (in contemporary markets) Treasury Inflation-Protected Securities (TIPS), would have provided a ballast to offset the losses from stocks and bonds. As such, a more diversified portfolio would have generated reasonable returns during this otherwise “lost” decade.

Why is this particularly important today? Well, It’s always important been important, but more so now as slowing global growth, increasing trade tensions and changing inflation expectations point to a possible regime shift where asset classes that thrive in more hostile environments (the 1970s or 1930s) maybe be underrepresented in investor portfolios.

TOP PICKS

SPROTT PHYSICAL GOLD TRUST (PHYS)

HORIZONS U.S. 7-10 YEAR TREASURY BOND ETF (HTB)

U.S. DOLLAR

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| PHYS | N | N | N |

| HTB | N | N | Y |

| USD | N | N | N |

PAST PICKS: JAN. 29, 2019

ISHARES 20+ YEAR TREASURY BOND ETF (TLT NASD)

- Then: $121.02

- Now: $ 165.17

- Return: +36%

- Total return: +40%

SPDR INTERNATIONAL REAL ESTATE ETF (RWX NASD)

- Then: $ 38.55

- Now: $25.97

- Return: -33%

- Total return: -23%

HORIZONS GLOBAL RISK PARITY ETF (HRA TSX)

- Then: $9.98

- Now: $10.04

- Return: +1%

- Total return: +2%

Total return average: +6%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| TLT | N | N | Y |

| RWX | N | N | N |

| HRA | Y | Y | Y |

COMPANY TWITTER: @investresolve

PERSONAL TWITTER: @MikePhilbrick99

WEBSITE: www.investresolve.com

OTHER: https://riskparity.ca/