Jul 14, 2022

More BOJ Watchers See Kuroda Staying Course With Ultra-Low Rates

, Bloomberg News

(Bloomberg) -- An increasing number of economists think Bank of Japan Governor Haruhiko Kuroda won’t budge in the final lap of his term, in sharp contrast to lingering market speculation that a pivot toward policy tightening may be near to hand.

All 47 economists said the central bank will keep its yield curve control and asset purchases unchanged at the end of a two-day meeting on July 21, according to a Bloomberg survey. Only 14% expect a policy tightening before Kuroda ends his decade-long stint in early April, dropping from 22% in the survey last month.

Despite a further slide in the yen this week to fresh 24-year lows and central banks around the world continuing to surprise with outsized rate hikes, economists see the BOJ cementing its outlier status even further.

Click here to read the full survey results.

Kuroda has repeatedly said Japan’s slow economic recovery from the pandemic requires continued monetary stimulus, given the risk of a drag on consumer spending from cost-push inflation. The BOJ’s new economic projections are expected to support his view next week, with a downgrade in growth forecasts and upward revisions in the inflation outlook, according to the survey.

Economists see the new quarterly inflation forecast at 2.1% for this fiscal year, up from 1.9% in the previous projection, according to the survey. The growth outlook will fall to 2.4% from 2.9% for the same period, the poll showed.

Kuroda remains in a dilemma as Japan’s rock-bottom rates contribute to a rapid weakening of the yen as the BOJ’s policy gap with its global counterparts continues to widen. Following the surprise US inflation report Wednesday, the currency hit a fresh 24-year low, as bets for a 100-basis point rate hike from the Federal Reserve jumped.

Economists now say 145 yen to the dollar is the level that would prompt the central bank to adjust policy, softening yet again from last month’s 140 view as the yen keeps sliding.

Still, an uptick was seen for the possibility of government intervention to stop the yen depreciation. Some 17% said it is either likely or very likely that the state will take direct action in the markets, up from 7% in June.

The upcoming BOJ policy meeting is the first to come after last week’s murder of former premier Shinzo Abe and Prime Minister Fumio Kishida’s strong election victory. The positive result for Kishida’s ruling party has reduced the need to pressure the BOJ to adjust policy for now, some economists said.

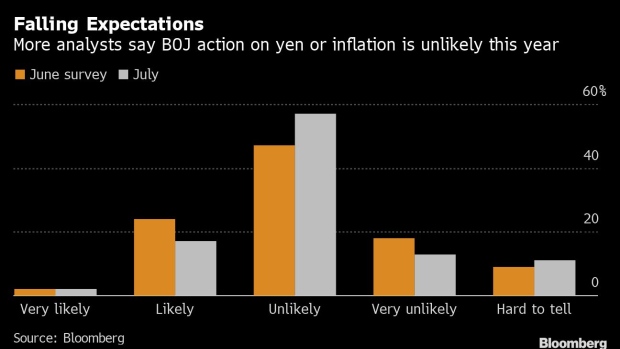

Some 70% said it’s unlikely or very unlikely that the BOJ will take some kind of action to address the weak yen or inflation this year, rising from 65% in the previous survey. More than half, or 57%, agreed with Kuroda’s argument that any rate hike now would do more harm than good to the overall economy.

Japan is seeing a surge in Covid infection cases in recent weeks, helping divide analysts’ view on when and how the central bank may eventually end its remaining coronavirus funding measures that are currently scheduled to end in September. Tokyo’s Metropolitan Government has already raised the Covid infection alert for the capital to its highest level this week.

Some 36% of respondents said the BOJ will decide on whether it extends the pandemic program at this meeting while 26% said that won’t happen. Those who said the program won’t end as scheduled outnumbered those who said it would.

©2022 Bloomberg L.P.