May 5, 2023

Most Economists See ECB Raising Rates Twice More by July

, Bloomberg News

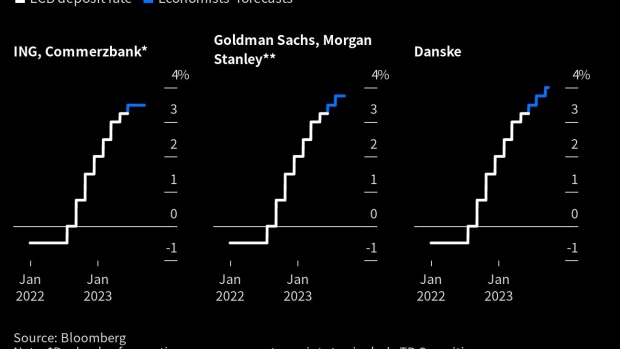

(Bloomberg) -- Most economists predict the European Central Bank will deliver two more quarter-point increases in interest rates following this week’s move.

Policymakers raised their deposit rate to 3.25% on Thursday, slowing their pace of tightening as they near the end of their unprecedented hiking cycle. President Christine Lagarde explained that there’s still more ground to cover before rates reach levels that are sufficiently restrictive to return inflation to the 2% target.

Banks including Goldman Sachs and Morgan Stanley see another two 25 basis-point steps — taking the deposit rate to 3.75%. ING and Commerzbank anticipate just one such hike, while Danske Bank expects three for a terminal rate of 4%.

The Majority Opinion: Two More Hikes

Goldman Sachs

“While renewed banking concerns in Europe could lead to an earlier end to the tightening cycle, we still see risks skewed towards a higher terminal rate given resilient growth, strong wage settlements and sticky core inflation.”

Morgan Stanley

“Clearly, the share of the Council that is concerned about the risks of doing too much has increased and it was large enough to slow things down considerably.”

Barclays

“We think the tightening cycle will end in July with the deposit rate at 3.75%. We then expect the ECB to remain on hold until H2 24, when we expect it to cut policy rates cumulatively by 100bp over the following six months to return to a more neutral level. This view is based on our growth outlook, which is less optimistic than that of the ECB, and our view that core inflation will also decelerate after the summer and converge to target faster than the ECB expects.”

Nordea

“We see risks both ways. Further financial market turbulence or a more rapid loss of momentum for the economy could stop the hiking cycle short, while sticky inflation could easily keep the ECB tightening rates also beyond the summer.”

UniCredit

“The rate guidance appears fairly vague (surely on purpose) and points to at least one more hike. Instead, the QT guidance looks explicit and hawkish, given that the ECB now expects to stop APP reinvestments in July.”

ABN Amro

“We think that as the tightening feeds through, the economy is likely to prove much weaker than the ECB currently expects in the second half of the year. As such, we expect an easing cycle to start from around the turn of the year.”

Credit Suisse

“The ECB has maintained that the ‘inflation outlook still has significant upside risks,’ both because wage growth continues to accelerate, as evidenced by recent wage settlements, and because firms continue to expand their profit margins. Indeed, we do not expect a clear sustained decline in core inflation until Q3 of 2023.”

UBS

“Core inflation and underlying inflation will likely remain sticky over the coming months. At the June meeting, the ECB will present new staff macroeconomic projections, which we think will still not show that the ECB is fully on track to bring inflation back to 2% in 2024/25. But we think that the broader inflation environment will then slowly improve over the summer so that the ECB will not hike rates further in September.”

Nomura

“It is clear the ECB will continue to hike. Underlying inflationary pressures remain too strong, with the annual rate of April services inflation having continued to accelerate. Furthermore, wage growth remains of concern, and as Madame Lagarde underscored that risks to the outlook for core inflation remain to the upside. Moreover, during the press conference, Madame Lagarde intentionally emphasized “s” at the end of “decisions” when responding to a question during the Q&A, saying “Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary.”

Deutsche Bank

“We now see upside risks to our 3.75% call again — a 4%+ terminal rate is possible. Given sticky underlying inflation and robust labor market dynamics, the data going forward need to confirm that transmission is strengthening if the ECB hiking cycle is to stop at 3.75%.”

Berenberg

“The ECB’s assessment of growth and inflation today did not differ much from the baseline scenario which the bank had presented in March, with somewhat stronger concerns about wage inflation counterbalanced by a softer outlook for loan growth.”

BNP Paribas

“The previous rate increases to 3.25% will not be quite enough to get inflation under control. Further hikes are needed. We will reach the 3.75% mark this summer.”

Rabobank

“The Governing Council does not consider its job done. Whether this means one, two, or more rate hikes is left fully open. President Lagarde reiterated that the entire Governing Council remains determined to fight inflation, and that all Council members concluded that the inflation outlook remains too high and has been so for too long.”

RBC

“Perhaps conscious of the dovish optics of a step down in the pace of rate hikes, ECB President Lagarde was at pains to balance this with a hawkish message. Lagarde emphasized that inflation was projected to be ‘too high for too long’ and that ‘There are still significant upside risks to the inflation outlook’.”

TS Lombard

“Shifting down to 25 basis-point hikes does not bring the ECB closer to a pause [...] The ECB is clear that the ‘inflation outlook continues to be too high for too long’ and that there is ‘more ground to cover.’ So, the question remains where the ECB will stop. For now, we stick to our call for a 3.75% terminal rate.”

A Popular View: Cycle About to End

ING

“Although recent data has confirmed that underlying inflationary pressure is stickier than expected, weak credit growth and the latest results of the Bank Lending Survey have indicated that the rate hikes so far are leaving clear marks on the financing of the economy. Or as the ECB put it and unsurprisingly for all Star Wars fans on May the 4th: “the past rate increases are being transmitted forcefully to euro area financing and monetary conditions, while the lags and strength of transmission to the real economy remain uncertain.”

Commerzbank

“We do forecast an end to interest rate hikes for the summer. But we do not expect that in the end this will be enough to bring inflation back to 2% sustainably. This is because inflation tends to get stuck at high levels. Overcoming this self-stabilizing tendency of high inflation requires decisive countermeasures. An ECB deposit rate of 3.5% is probably not enough.”

TD Securities

“We expect the ECB to hike once more in June, taking the deposit rate to a terminal of 3.50% [but] further persistence through the summer could see a final July hike to 3.75%, and tight labour market dynamics might be all that’s required to get there. That said, tighter global financial conditions on the back of US banking system stress may substitute for ECB rate hikes on the margin.”

Bank J Safra Sarasin

“President Lagarde confirmed that the ECB is not done tightening monetary policy yet and that it has more ground to cover. While this should not be interpreted as forward guidance toward more rate hikes in the future, it is clearly more than a pure data-dependent approach.”

MFS Investment Management

“The ECB’s tone on inflation remains hawkish but it seems that data are consistent with no upward revisions for inflation in the medium term are on the cards. The ECB acknowledged that past increases in rates are transmitted forcefully, suggesting the ECB is carefully looking at how the transmission of past policy moves add downside risks to the economy in the medium term (and implicitly on inflation). Such considerations add a modest dovish twist to the decision today.”

NatWest

“We see a further rate rise to 3.5%. The risk is clearly that there will be another rate hike in July (to 3.75%) in line with Lagarde’s emphasis on the language in the statement regarding ‘future decisions’ [our emphasis to reflect the President’s!]. But we expect that by then, it will be clear that the additional small increment is not needed”

The Outlier: Three More Rate Increases

Danske

“The ECB has taken a slower route to bring inflation in line with target. Lagarde repeated several times that it is a journey and not the destination and hence an open mind to the rate decisions is kept. With our current inflation and growth assessment we warrant that this tightening cycle will be slightly longer but still end around the 4% level. It will likely take some time for markets to fully appreciate this terminal rate pricing.”

©2023 Bloomberg L.P.