Aug 7, 2018

Musk mulls taking Tesla private, valuing company at US$82B

, Bloomberg News

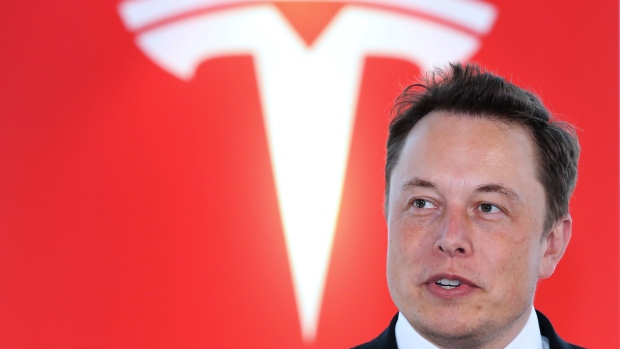

Elon Musk is considering taking Tesla Inc. (TSLA.O) private in a radical step that would ease pressure on the money-losing automaker.

The announcement, made initially via Twitter Tuesday afternoon, stunned investors and sent Tesla’s stock price soaring as much as 13 per cent.

It followed news that Saudi Arabia’s sovereign wealth fund had built a less than five per cent stake in Tesla worth about US$2 billion.

And yet it also left many questions unanswered, namely how Musk -- who owns almost 20 per cent of the company -- would be able to come up with the US$66 billion necessary to complete the transaction. At US$420 a share, Tesla would have an enterprise value of about US$82 billion including debt. To take it private, the billionaire would have to pull off the largest leveraged buyout in history, surpassing Texas electric utility TXU’s in 2007.

Tesla stock was halted for more than an hour and a half and resumed trading up 11 per cent to US$380.60 as of 3:49 p.m. in New York. The rally falling well short of US$420 is a sign of market skepticism that Musk’s plan is feasible. The CEO said shareholders would have the final say if he decides to follow through on going private, and that he would stay in his job.

Like SpaceX, but not with SpaceX

Musk wrote in an email to employees on Tuesday that the idea behind going private was to focus on execution away from market pressures.

“I fundamentally believe that we are at our best when everyone is focused on executing, when we can remain focused on our long-term mission, and when there are not perverse incentives for people to try to harm what we’re all trying to achieve,” he wrote.

“This is especially true for a company like Tesla that has a long-term, forward-looking mission. SpaceX is a perfect example: it is far more operationally efficient, and that is largely due to the fact that it is privately held. This is not to say that it will make sense for Tesla to be private over the long-term. In the future, once Tesla enters a phase of slower, more predictable growth, it will likely make sense to return to the public markets.”

However, Musk explicitly said there is no plan to combine Tesla with SpaceX.

“[T]he intention is not to merge SpaceX and Tesla,” he wrote. “They would continue to have separate ownership and governance structures.”

“However, the structure envisioned for Tesla is similar in many ways to the SpaceX structure: external shareholders and employee shareholders have an opportunity to sell or buy approximately every six months.”

Musk’s Math

There was some skepticism in the market Tuesday about the viability of Musk taking his car maker private.

"Assuming that Musk is right and he has a backer, shareholders should take the US$420 offer and bail out," Strategic Analysis Corporation Chairman Ross Healy told BNN Bloomberg via email, "because if they don’t, they will be stuck in an illiquid investment which is steadily falling in [book] value where they can’t get out and there is no access to cheap equity funds to keep the balance sheet afloat."

Healy, whose firm does not own Tesla shares, laid out the equation on Twitter, referencing the famous quip often attributed to American showman P.T. Barnum that “there’s a sucker born every minute”.

‘Lot of Noise’

Musk has a long history of bristling at the amount of scrutiny Tesla endures from investors and media.

In an interview with Bloomberg News in January 2015, he spoke of the benefits of running his closely held rocket company Space Exploration Technologies Corp. and his frustrations with having taken Tesla public in June 2010.

“There’s a lot of noise that surrounds a public company and people are constantly commenting on the share price and value,” Musk said in 2015. “Being public definitely increases the management overhead for any given enterprise.”

Dueling Views

Taking Tesla private “makes a ton of sense,” said Gene Munster, a managing partner at venture capital firm Loup Ventures.

“Elon Musk does not want to run public companies,” Munster said. “His missions are big and make it difficult to accommodate investors quarterly expectations. Our guess is there is a 1 in 3 chance he can actually pull this off.”

With files from BNN Bloomberg

WEIGH IN