Dec 11, 2023

New Zealand Immigration Hits Fresh Record High as Policymakers Fret

, Bloomberg News

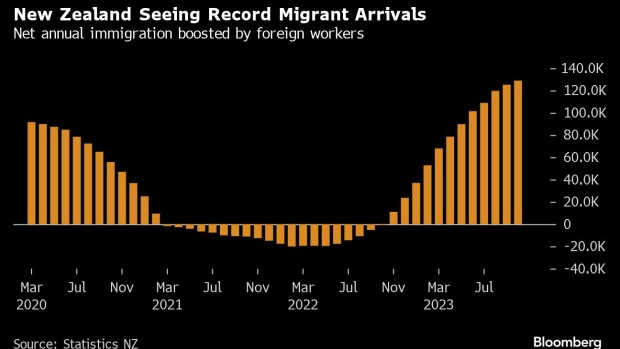

(Bloomberg) -- New Zealand’s inflow of migrants climbed to a fresh record high, extending further into “unsustainable” territory and giving the central bank more cause to ponder whether another interest-rate increase is needed.

Net immigration rose to more than 128,900 in the year ended October, Statistics New Zealand said Tuesday in Wellington. The gain comprised the arrival of about 173,400 non-New Zealand citizens, offset by citizen departures of 44,500.

The Reserve Bank’s initial relief post-Covid that foreign workers would ease labor market pressures and wage inflation has now turned to concern about a fresh wave of demand as inflation remains sticky. Last month the RBNZ surprised markets by signaling a greater risk of a rate hike next year, citing concern the flood of new arrivals is pushing up rents and house prices.

Deputy Governor Christian Hawkesby told Bloomberg earlier this month the central bank can’t afford to ignore the surge in immigration, even though it’s expected to subside next year, because inflation has been above its 1-3% target for so long. The RBNZ projects the gauge, currently 5.6%, will return to the top of the band by the third quarter of 2024.

RBNZ Can’t Afford to Ignore Immigration Surge, Hawkesby Says

Prime Minister Christopher Luxon said Monday that immigration above the 118,000 level reported in September “doesn’t feel sustainable” and that he expected it to begin to decline. The government hasn’t set any target but intends to find a balance to ensure skills shortages are being filled but without stressing the nation’s housing and other infrastructure, he said.

Tuesday’s report showed net arrivals in October were the lowest since December at about 9,300 — adding to signs the influx may be losing steam.

“We expect the RBNZ to remain wary of a net migration boost to housing and economy-wide inflationary pressures,” said Mark Smith, senior economist at ASB Bank in Auckland. “With core inflation only slowly declining, restrictive OCR settings will be needed for a while yet. We do not expect cuts until 2025.”

©2023 Bloomberg L.P.