Mar 25, 2024

Nissan Drops After Setting New Mid-Term Targets for EVs, Sales

, Bloomberg News

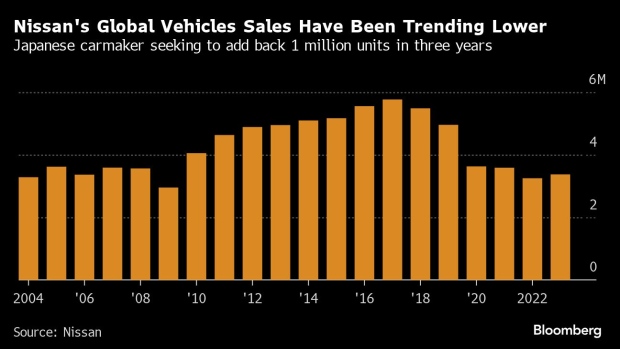

(Bloomberg) -- Nissan Motor Co. shares fell the most in six weeks after the Japanese automaker detailed a new mid-term plan that calls for 1 million additional vehicle sales within three years, a target that one analyst described as “aggressive.”

The Japanese carmaker will add 30 new models, 16 of which will be electrified, by March 2027, Makoto Uchida, Nissan’s chief executive officer, said at a news conference Monday. Nissan is also seeking to reduce the cost of next-generation EVs by 30%. The stock fell as much as 6% in morning trading in Tokyo, its biggest intraday decline since Feb. 9.

The new sales target effectively seeks to regain lost ground over the past few years. Nissan is targeting 3.55 million unit sales for the current fiscal year, which ends this month, compared with roughly 5 million five years ago. An aging product pipeline, lack of hybrid options in North America and intensifying competition in China have all contributed to the decline.

“We have to change our ways to compete with companies like BYD,” Uchida said in an interview with Bloomberg News. Nissan, he added, must be “flexible” in its approach.

Read More: Nissan Plans to Boost Sales by 1 Million Cars by 2027

Even so, it’s forecasting higher operating profit during the period, thanks to cost-cutting measures. Nissan is also seeking to achieve an operating profit margin of at least 6% by March 2027.

“The shares have been rallying ahead of the announcement; our first take is that news flow now seems to be exhausted,” Arifumi Yoshida, director of pan-Asia autos coverage at Citigroup Global Markets Japan Inc., wrote in a report. The goal of raising sales by 1 million “looks aggressive,” he added.

Nissan is also looking to launch new models in North America, Canada, Japan and Europe through March 2027, and invest $200 million in the US.

“We can’t succeed if we keep doing things the same way,” Uchida said at the news conference.

©2024 Bloomberg L.P.