Oct 17, 2019

No One Wants to Short Stocks on the Cusp of a Potential Breakout

, Bloomberg News

(Bloomberg) -- With U.S. stocks making another run at all-time highs, short sellers are stepping aside.

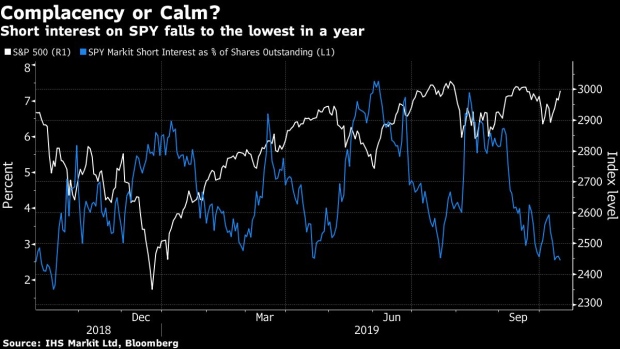

Bets against the SPDR S&P 500 ETF Trust as a percentage of shares outstanding fell to just 2.55% this week, the lowest level in a year, according to data from IHS Markit Ltd. U.S. equities are less than 1% away from a record, and rose 0.6% as of 9:48 a.m. in New York on Thursday.

Stocks have climbed as evidence mounts that two of the largest market overhangs -- a U.S.-China trade war and Brexit -- could be resolved. President Trump said over the weekend that the first phase of a trade deal could be signed soon, and a new Brexit framework was announced Thursday. While economic data has been contradictory, any signs of a stabilization in growth could pave the way for a rally into year-end.

“Cyclicals have room to move higher relative to defensives in 4Q,” Evercore ISI’s Dennis Debusschere, the firm’s head of portfolio strategy, wrote in a note to clients Wednesday. “A strong equity market showing in 4Q is more dependent on investors discounting lower odds of a recession rather than a material increase in expectations for economic growth.”

But investors may be taking too much comfort from talk of a trade deal between the U.S. and China, according to Morgan Stanley’s Mike Wilson, who warned earlier this week that the next few months could resemble last year’s sell-off.

Stocks plunged 14% in the fourth quarter of 2018, with the bulk of that decline coming after short positions on the SPY exchange-traded fund slumped.

Cash has also flowed into leveraged products that bet on higher equity volatility. The VelocityShares Daily 2x VIX Short Term ETN added $110 million earlier this week, the biggest one-day inflow since March.

“We fully expect Friday to mark the near-term highs and the next few weeks/month to resemble what we saw last December,” Wilson wrote in a note.

To contact the reporter on this story: Sarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Rachel Evans, Randall Jensen

©2019 Bloomberg L.P.