Nov 1, 2022

Nomura Quant Sees S&P 500 Rebound Momentum Slowing After Fed

, Bloomberg News

(Bloomberg) -- Derivatives cues imply the pace of the ongoing rebound in the S&P 500 benchmark is likely to dwindle after the Federal Reserve’s rate decision later this week, according to Nomura Holdings Inc.

The comparatively low volatility ahead of Wednesday’s Fed meeting shows that the options market is “increasingly optimistic” about the event, quantitative strategist Yoshitaka Suda wrote in a note dated Oct. 31. A shift in options hedging by traders could also weigh on the market, he added.

Hopes of a dovish turn in the US central bank’s monetary policy have increased, even as policy makers are poised to carry out a fifth-straight outsized rate hike on Wednesday. The S&P 500 Index has so far failed to escape a technical bear market it entered in June. In its most recent attempt, the gauge has climbed 9% since Oct. 12, when it closed at the lowest level since Nov. 2020.

The risk to stocks from the Fed meeting look to be mainly on the downside as the one-week implied volatility skew for the S&P 500 is “in the 20th percentile for the week prior to FOMC meetings since January 2012,” Suda wrote.

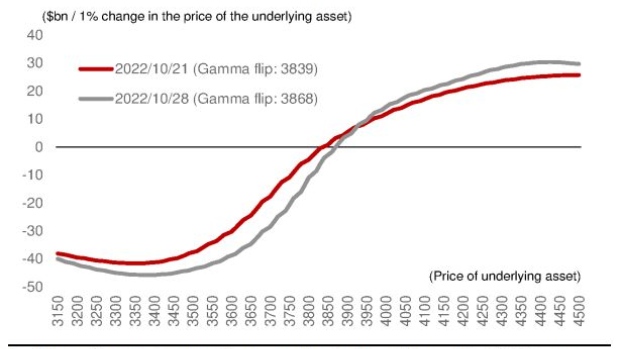

He said short covering by fast-money traders, or so-called commodity trading advisers, has driven much of the rebound but “dealers’ gamma position has already shifted from the short to the long side.” That leaves traders to go against the prevailing equity trend to maintain a neutral market exposure.

Such a move by traders could reduce the impact of commodity trading advisers’ unwinding of short positions. The net short position of CTAs in the S&P 500 contracted from 38% to 29% over the past two weeks, according to Nomura’s calculations.

©2022 Bloomberg L.P.