Nov 3, 2022

Norges Bank Slows Pace of Rate Hikes as Economy Cools

, Bloomberg News

(Bloomberg) -- Norway’s central bank slowed the pace of interest-rate increases amid signs the economy is cooling, in a move that divided economists and sparked bets that the bank will deliver a final hike next month.

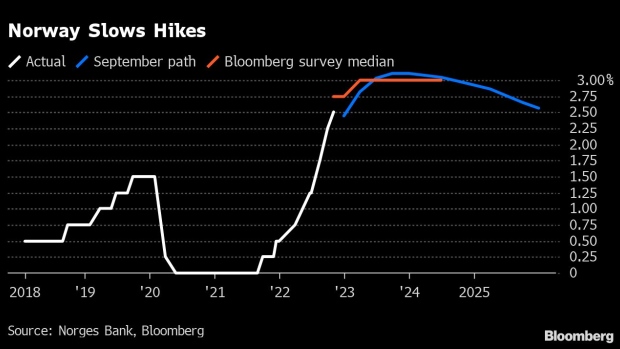

Norges Bank lifted its key deposit rate on Thursday by 25 basis points to 2.5%, the smallest increase in its benchmark rate since raising the pace of tightening in June. The hike brings the rate to its highest level since 2009, with policymakers saying it will “most likely be raised further in December.” They didn’t give clues on the size of the next hike.

The move suggests Norges Bank again becomes one of the central banks charting a new direction for monetary policy, after it was first among major economies to start raising rates in September 2021. Thursday’s step had split the economists, with an equal number of forecasters expecting the bank would continue a string of half-point hikes to stem inflation that’s at a 34-year high.

The krone fell by as much as 0.8% to a one-week low of 10.3710 per euro after the rate decision. It traded at 10.3545 per euro as of 14:15 p.m. in Oslo.

“As such, the September meeting marked a shift toward more moderate rate hikes going forward and a central bank that will use the time to assess the effects of the hikes already delivered,” Nordea’s economists Dane Cekov and Kjetil Olsen said in a note to clients. The news is “to the dovish side to markets expectations,” they said, adding that Norges Bank is likely to hike by a quarter point in December.

The step follows a fourth straight 75 basis-point hike by the Federal Reserve on Wednesday, while the Bank of England made a similar-sized increase in borrowing costs after the Norwegian decision. Elsewhere in the region, neighbor Sweden may opt for a bigger increase later this month than the 50 basis points signaled by the Riksbank so far.

Norway’s policymakers have faced a tough trade-off, being wrong-footed by surging inflation like their peers, while the oil producer’s economy is seen shrinking next year, in line with its Nordic neighbors.

Governor Ida Wolden Bache has stressed the unusually uncertain outlook with bigger-than-expected slumps in housing and in spending by households -- some of the world’s most indebted -- among the potential risks.

“We are seeing signs of a cooling housing market,” she told reporters, speaking before data from Eiendom Norge showed house prices declined in October for a second month, exceeding the central bank’s forecast.

Read More: Norwegian House Prices Extend Slide as Interest Rates Lifted

While the krone exchange rate has been “somewhat weaker than projected in our September report, it has appreciated more recently,” Wolden Bache said in a separate interview with Bloomberg. The exchange rate “is now quite close to where we expected it to be in the fourth quarter when we made our projections in September.”

A quarter-point hike in December will likely be final, with 2.75% marking the peak in policy rates, said Kristoffer Kjaer Lomholt, head of FX and corporate research at Danske Bank A/S, though “there’s a non-negligible risk that the peak in policy rates has already been reached.”

Swedbank’s economists Kjetil Martinsen and Marlene Skjellet Granerud also said the probability of 25 basis point increase in December as the last hike has “markedly increased.”

Two months ago the central bank forecast a rise in the policy rate “to around 3% in the course of winter,” a projection it didn’t reiterate Thursday in the absence of an updated economic outlook or estimates for the path of interest rates.

There’s little reason to think Norges Bank would change the end-point of that guidance, Martinsen and Granerud said in a note to clients. “This somewhat increases the probability of a soft landing, as the central bank is more attentive to signs of a slowdown in the economy.”

--With assistance from Harumi Ichikura, Jonas Cho Walsgard and Love Liman.

(Updates with more governor’s comments, housing data)

©2022 Bloomberg L.P.