Mar 8, 2019

Norway gives US$1 trillion fund go-ahead to divest its oil stocks

, Bloomberg News

Big Oil dodged a bullet.

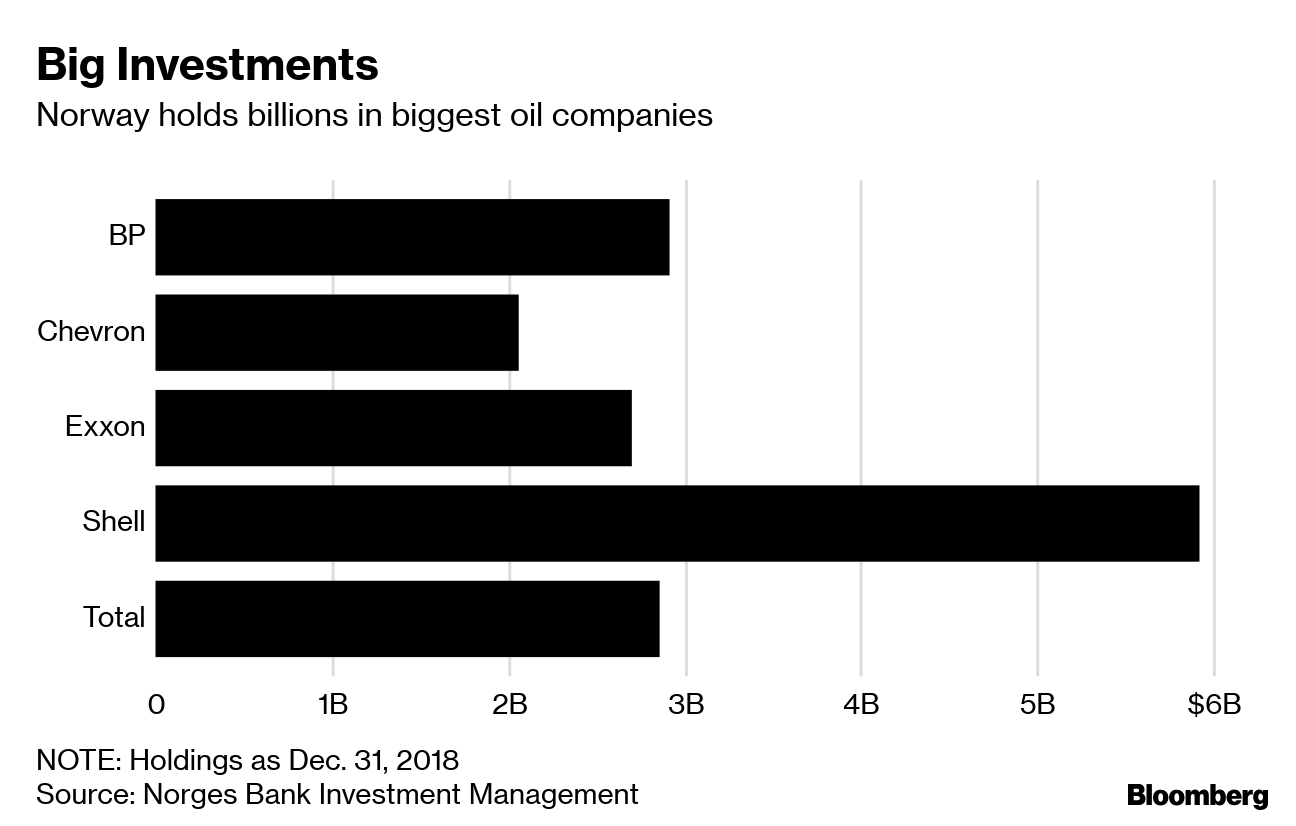

Norway took a partial step in divesting oil and gas stocks in its massive US$1 trillion wealth fund, approving the sale of smaller exploration companies while sparing the biggest producers such as Royal Dutch Shell Plc and Exxon Mobil Corp.

After more than a year of deliberation, the government on Friday approved excluding 134 companies classified as exploration and production companies by FTSE Russell, including Anadarko Petroleum Corp., Chesapeake Energy Corp., Cnooc Ltd. and Tullow Oil Plc. The proposal would see the fund sell about $7.5 billion in stocks.

“It reflects to a larger extent the risk we ourselves have -- the bulk of the state’s exposure in Norway is upstream activity,” Finance Minister Siv Jensen said after the decision. “We’re reducing our vulnerability by choosing to withdraw the fund gradually from this segment.”

The government goes part of the way in meeting a 2017 proposal from the fund, which rattled global markets by calling for a full divestment of the oil and gas sector. That plan was then hailed as a potential huge step by climate activists. It has also been a hot-button issue in Norway, which is seeking to project an image as a responsible environmental steward while pumping oil and gas at a fast clip.

Jensen defended her decision to keep the big oil companies in the portfolio.

“The integrated companies will most probably be the companies that will increase their investments in a much broader spectrum of the energy industry going forward,” she said. “These are the companies making the big investments now in renewables and so on.”

Exiting from this “would in reality have constricted the fund’s chance to take part in this type of investments,” she said.

The partial move underscores the changing political climate in Norway, where opposition to oil and gas exploration is on the rise. Prime Minister Erna Solberg’s Conservative Party has been a long-time friend to the oil industry.

The $1 trillion fund has been built up over the past two decades from oil and gas revenue and Norway also uses large chunks of income from its offshore fields each year to pay for its lavish welfare state. The managers of the fund, which is overseen by the central bank, therefore argued in their proposal that it makes little sense for Norway to be doubly exposed to oil both in its revenue stream and through its investments.

Sony Kapoor, managing director at think tank Re-Define, said the limited divestment “‘represents a victory of Big Oil lobbying over financial prudence and common sense.”

--With assistance from Kelly Gilblom and Annmarie Hordern.

WEIGH IN