Mar 7, 2024

OECD Warns About Debt Market Danger as Maturity Wall Looms

, Bloomberg News

(Bloomberg) -- Global bond markets are facing significant challenges as governments and companies have to refinance about 40% of maturing debt in the coming three years, potentially at higher costs, according to the Organization for Economic Cooperation and Development.

In a report published Thursday, the Paris-based organization estimated that total government debt issued by its 38 member countries will rise by $2 trillion to a record of $56 trillion this year.

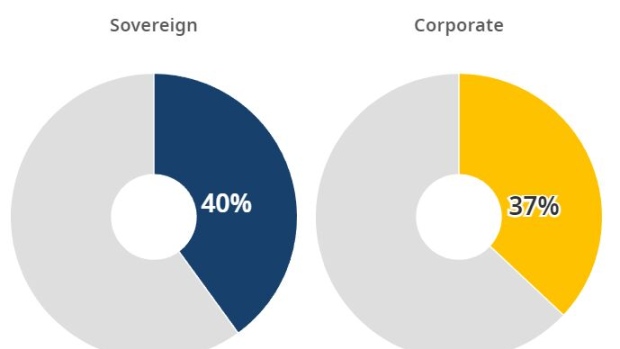

The OECD said that favorable funding conditions between 2008 and 2022 allowed governments and companies to borrow at low costs. But around 40% of sovereign bonds and 37% of corporate bonds globally will mature by 2026.

By then, issuers will likely roll over most of their debt at higher borrowing costs, even if central banks succeed in cooling inflation, it said.

Meanwhile, central banks are paring back their bond holdings, leaving price-sensitive investors to absorb the net supply at record levels, it added.

“A new macroeconomic landscape of higher inflation and more restrictive monetary policies is transforming bond markets globally at a pace not seen in decades,” OECD Secretary-General Mathias Cormann said in a statement.

“Market supervisors need to monitor closely both debt sustainability in the corporate sector and overall exposures in the financial sector.”

The OECD warned that several highly indebted countries, including some of its members, may “potentially face a negative feedback loop” of rising interest rates, slow growth and growing deficits.

It singled out the non-financial corporate sector, where “risk-taking has increased substantially,” as a potential pressure point.

At the end of 2023, 53% of investment-grade debt sold by non-financial companies was rated as BBB, the lowest high-quality rating that’s available, according to the report. The share of these ratings of the investment-grade corporate universe has more than doubled since 2000, the OECD said.

Meanwhile, the share of BBB-rated bonds with ratios of debt to earnings before interest, tax, depreciation and amortization of over 4 times – an indicator of high leverage – jumped to 42% in 2023, from 11% in 2008, the OECD found.

“Given the decreasing quality of investment-grade bonds and the limited capacity of the market to absorb a large increase in non-investment grade supply, the implications of potential downgrades merit consideration,” the report said.

©2024 Bloomberg L.P.