Feb 13, 2023

Oil dips in choppy trade as supply recovery counters Russia cut

, Bloomberg News

Futures market looks ugly for oil and gas: Robert Yawger

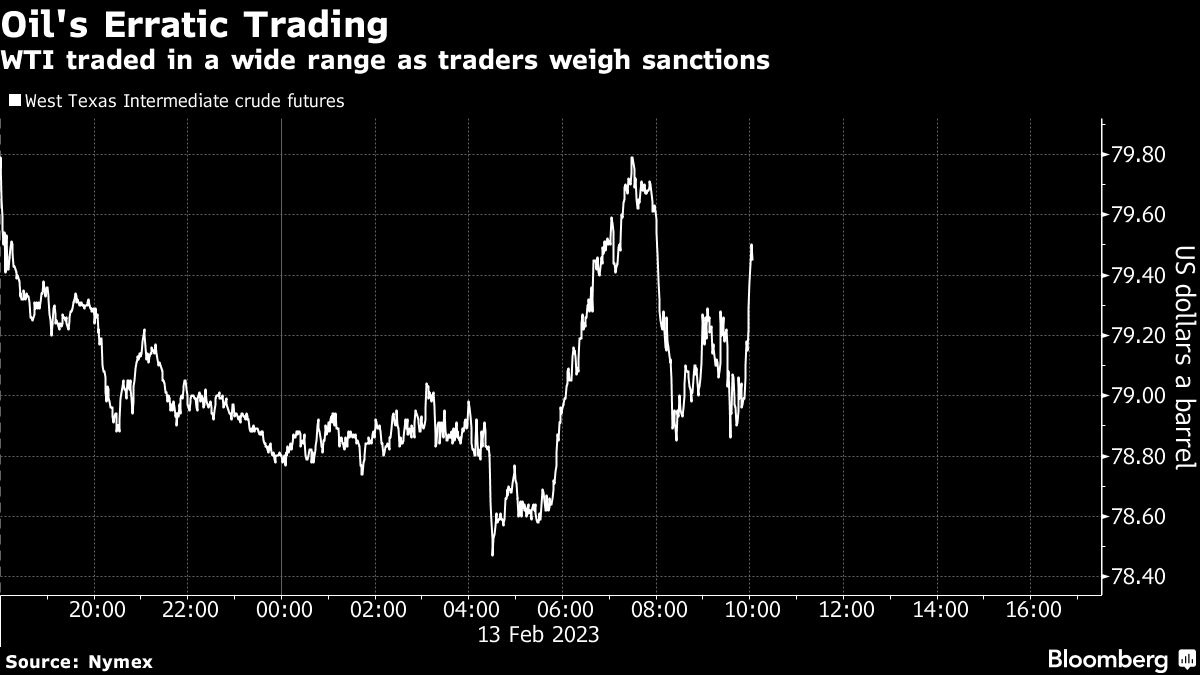

Oil edged down in an erratic trading session as the return of oil exports out of Turkey allayed immediate concerns over a looming reduction in Russian supply.

West Texas Intermediate futures briefly mustered a rally to erase a drop of 1.6 per cent before succumbing under the weight of returning volumes. Loadings of Azeri crude at the Turkish port of Ceyhan resumed Sunday, ending a major supply disruption following last week’s devastating earthquake.

On Friday, Russia announced it would slash its output by half a million barrels a day. The decision led to a significant uptick in bullishness in the options market, while firming up timespreads. The European Union said Russia was forced into the cut as sanctions have restricted Moscow’s ability to find buyers.

Crude has had a bumpy start to 2023, bouncing within a band of about US$10, as Russia’s yearlong war in Ukraine continues to roil the energy market. On the demand side, the outlook is bolstered by China’s emergence from COVID curbs, but clouded by investor concern over U.S. moves to push interest rates higher.

“Volatility has been the name of the game so far in 2023,” RBC Capital Markets analysts, including Michael Tran and Helima Croft, said in a note. “Given the macro dominance, most oil traders see near-term rangebound markets with upside price skew, but strong directional views are weakly held.”

Prices and other news:

- WTI for March delivery fell 66 cents to US$79.06 a barrel at 10:34 a.m. in New York

- Prices rallied 8.6 per cent last week

- Brent for April settlement fell 73 cents to US$85.66 a barrel.