Mar 23, 2023

Oil drops as investors assess Fed's message, outlook for dollar

, Bloomberg News

The oil market is oversold: Analyst

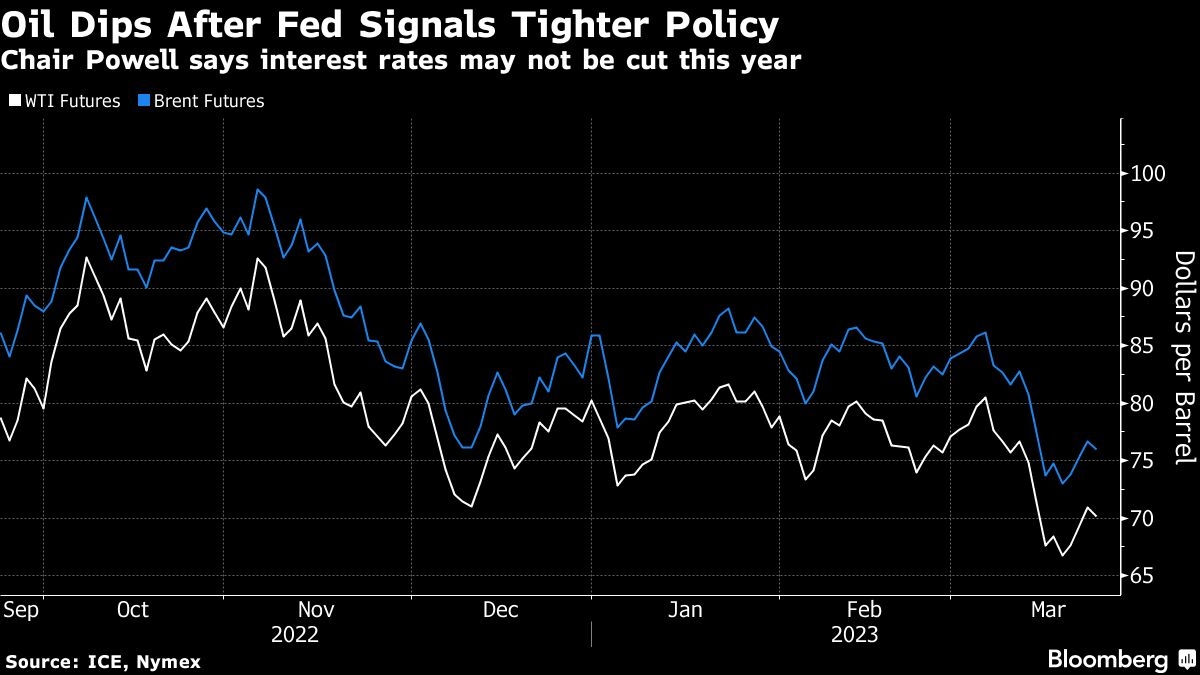

Oil fell as investors weighed the Federal Reserve policy outlook after another hike and digested a mixed snapshot of U.S. supply and demand.

West Texas Intermediate futures for May dipped toward US$70 a barrel, although they traded off the intraday low as the dollar eased. Fed Chair Jerome Powell advised that more tightening may be in store after Wednesday's 25 basis-point rise, and added that rates won't be cut this year. The comments came less than two weeks after the most severe banking crisis since 2008.

The appeal of risk assets including commodities was also bruised after Treasury Secretary Janet Yellen said regulators weren't looking to provide “blanket” deposit insurance to stabilize the banking system without working with lawmakers, putting the focus back on the fragility of financial institutions.

Crude is headed for the steepest first-quarter drop since 2020, when the pandemic hammered demand. The slump has been driven by concerns about a potential U.S. recession, robust Russian flows despite Western sanctions, and the banking turmoil. Still, there are signs of strong demand in Asia as China recovers after the nation ditched its Covid Zero policy late last year.

“Clearly, macro will remain the key driver for price direction in the short term,” said Warren Patterson, head of commodities strategy for ING Groep NV. “Comments from Yellen related to a blanket deposit insurance appear to have put some renewed pressure on risk assets, including oil.”

Prices:

- WTI for May delivery fell, snapping a three-day gain, to lose 0.7 per cent to US$70.44 a barrel at 7:14 a.m. in London.

- Brent for May settlement eased 0.5 per cent to US$76.30 a barrel.

As traders weighed the Fed's likely course of action over 2023 the dollar eased on Thursday, offering support to raw materials including oil that are priced in the currency. With the U.S. central bank's hiking cycle nearing an end, the greenback should weaken and deliver a “strong tailwind for commodity markets,” according to Australia & New Zealand Banking Group Ltd.

U.S. nationwide crude stockpiles expanded to the highest level since May 2021 after strong builds on the Gulf Coast outweighed a decline at the Cushing, Oklahoma, storage hub, Energy Information Administration data showed. Still, oil exports jumped to a record, and gasoline holdings shrank again.