May 27, 2020

Oil extends drop after report stokes concerns over excess supply

, Bloomberg News

Lower demand drives oil prices lower

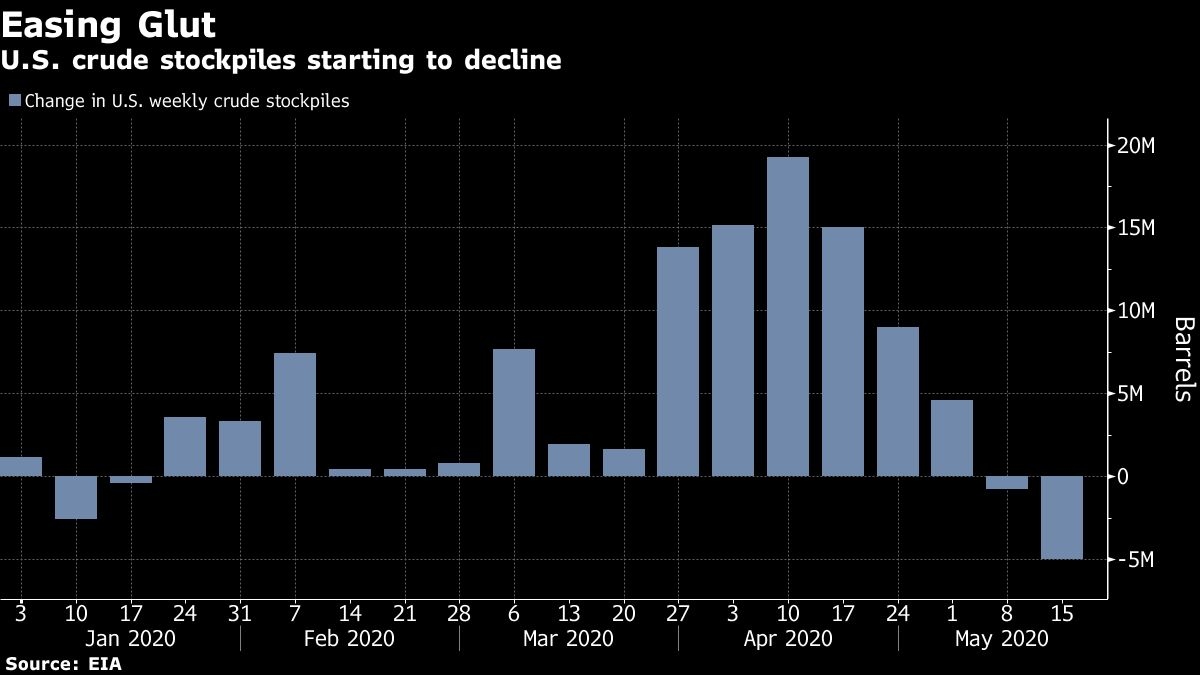

Oil fell a second day after a report showing a jump in U.S. crude stockpiles raised fresh concerns over excess supply, while doubts are also creeping in over Russia’s commitment to maintaining production curbs.

Futures in New York fell as much as 2.6 per cent, adding to Wednesday’s 4.5 per cent drop. The American Petroleum Institute reported that oil inventories rose by 8.73 million barrels last week, according to people familiar. If confirmed by government data on Thursday it would reverse two weeks of declines — an indication that record supply cuts are not draining a massive glut fast enough. Gasoline supplies also swelled by 1.12 million barrels, according to the report.

Russian President Vladimir Putin and Saudi Arabia’s Mohammed bin Salman on Wednesday reiterated their cooperation on the OPEC+ supply-deal ahead of a June 9-10 meeting. But earlier Moscow said that it wanted to scale back curtailments as soon as the current agreement expires in July, according to people familiar with the matter.

The API report also showed supplies at the key storage hub of Cushing, Oklahoma, fell by 3.37 million barrels, which would be the third consecutive weekly decline.

OPEC+’s commitment to reducing output by almost 10 million barrels a day starting in May has helped to lift oil prices by about 70 per cent this month. But the market’s recovery remains fragile, with higher prices likely to prompt producers to turn the taps back on even as the pandemic continues to quash energy demand.

The physical market has recovered in recent days as economies reopen. Indian, Chinese and South Korean refineries are buying distressed cargoes in a sign of returning demand. In the U.S., top infectious disease expert Anthony Fauci said that there is a chance that a coronavirus vaccine will be available by the end of the year and that U.S. testing capabilities are improving. The remarks feed optimism that the country could get back to work sooner than expected.

The damage inflicted by the COVID-19 pandemic continues to reverberate across the industry. Chevron Corp. is planning a 10 per cent to 15 per cent reduction in its global workforce this year, the biggest cut to headcount yet among global oil majors. Global energy investment will suffer a record slump of US$400 billion, or about 20 per cent, this year, the International Energy Agency said in a report on Wednesday.